By Kanchan Joshi | 19 Sep, 2021

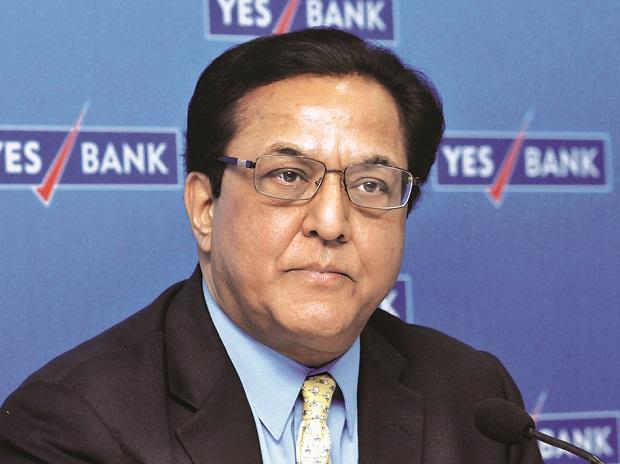

Yes Bank-DHFL case: Kapoor's wife, daughters remanded to judicial custody

A special CBI court in Mumbai on Saturday denied bail to the wife and two daughters of Yes Bank founder Rana Kapoor in a quid-pro-quo case involving private sector lender DHFL stating that they had, prima facie, caused loss of Rs 4,000 crore to the bank through illegal acts.The court, which remanded them in 14-day judicial custody, said the three did not deserve sympathy for being women or the mot...