28 Nov , 2022 By : Kaushiki Mehta

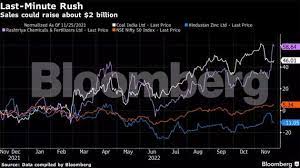

India plans to sell small stakes in state-run firms including the world’s biggest coal miner and Asia’s largest zinc producer, to ride a stock market boom and boost revenue in the final quarter of the financial year, according to people familiar with the matter.

The government is looking to sell 5%-10% in Coal India Ltd., Hindustan Zinc Ltd., Rashtriya Chemicals and Fertilizers Ltd. via the so-called offer-for-sale mechanism, the people said, asking not to be identified as the details aren’t yet public. In all, five firms could be chosen, including a listed entity under the railway ministry, they added.

India had budgeted Rs 65,000 crore from such asset sales in the year through March, but has so far raised just over a third of the target, mainly from the $2.7 billion initial public offering of Life Insurance Corp. in May.

Coal India jumped about 46% in the past year, while Rashtriya Chemicals gained 58%, out ..

0 Comment