03 Aug , 2021 By : Kanchan Joshi

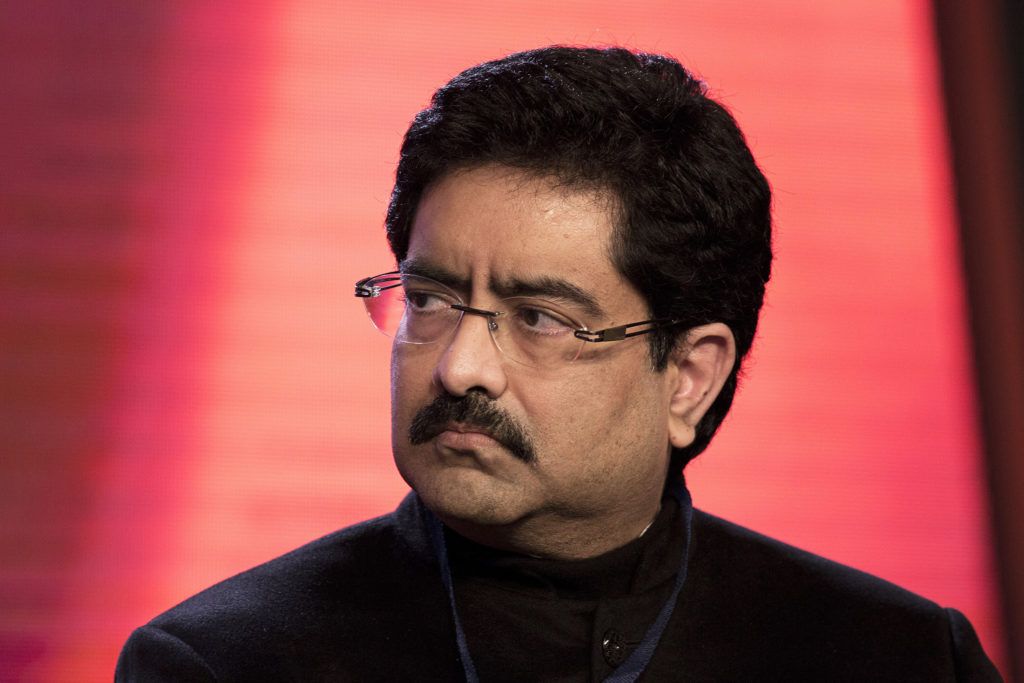

Aditya Birla Group chairman Kumar Mangalam Birla has offered to transfer the group’s entire ownership in Vodafone Idea Ltd to the government in a last-ditch effort to keep the cash-strapped telco from collapsing.

In a letter to cabinet secretary Rajiv Gauba in June, Birla expressed the group’s inability to fund the company any further.

“It is with a sense of duty towards the 270 million Indians connected by Vodafone Idea, I am more than willing to hand over my stake in the company to any entity—public sector/government /domestic financial entity or any other that the government may consider worthy of keeping the company as a going concern," Birla said in the letter.

On 26 July, Vodafone Idea’s controlling shareholders, UK’s Vodafone Group Plc and India’s Aditya Birla Group, were open to ceding control of the company if a strategic investor wants to take over.

The development marked new thinking by Vodafone Idea’s promoters, who were initially looking to onboard financial investors through a mix of debt and equity.

Those efforts have so far yielded no results, putting the survival of the telco at risk.

Birla, who owns around 27% of Vodafone Idea, said investors are unwilling to put money into the company without clarity on its adjusted gross revenue (AGR)-related liability, moratorium on spectrum payments and most importantly, a floor pricing regime above the cost of service.

Without immediate active support from the government on the three issues by July, the financial situation of Vodafone Idea will deteriorate further to an “irretrievable point of collapse", Birla said in the 7 June letter.

An Aditya Birla group spokesperson did not respond to requests for comment.

Vodafone Idea has recently expressed its inability to pay the telecom department the instalment of Rs8,292 crore that is due on 9 April 2022 since the company’s cash will be used for payment of adjusted gross revenue dues.

In a 25 June letter to the telecom secretary, Vodafone Idea had sought to pay the spectrum instalment in April 2023 instead of April 2022.

The company has reported a loss of around Rs7,023 crore for the quarter ended March. It had posted a loss of Rs11,643.5 crore in FY20.

Vodafone Idea needs to pay Rs22,500 crore between December 2021 and April 2022 to repay a mix of regular debt to lenders, AGR and spectrum dues. It has an AGR liability of Rs58,254 crore, out of which the company has paid Rs7,854.37 crore and Rs50,399.63 crore is due.

Last year, Vodafone Idea said that it would raise Rs25,000 crore through a mix of equity and debt issuances after the Supreme Court allowed it a 10-year payment period to settle its regulatory dues.

However, despite several rounds of talks with potential investors, the company has not been able to get a firm commitment from any strategic or financial investor, who have cited the low telecom tariffs and burgeoning liabilities as deal-breakers.

In a bid to reduce its AGR liabilities, Vodafone Idea, along with a few other telecom service providers, approached the Supreme Court, citing computation errors by the telecom department related to AGR dues.

The apex court, however, dismissed the petition in July, dampening its chances of raising funds.

According to industry experts, Vodafone Idea’s chances of revival on potential relaxation from the government in the form of a moratorium on spectrum dues as well as a substantial hike in tariffs appear bleak.

India’s telecom market is heading towards a duopoly, with Vodafone Idea teetering on the brink of collapse amid mounting dues to the government.

The entry of Reliance Jio Infocomm Ltd, controlled by Asia’s richest Mukesh Ambani, in 2016 triggered a bruising tariff war, forcing many incumbents to exit the market.

Since then, adverse court orders have left two of the remaining three private telcos struggling.

The weakest of the two, Vodafone Idea, is now banking on government help to avert a certain collapse.

0 Comment