25 Aug , 2025 By : Debdeep Gupta

The Nifty 50 erased recent days' gains and reversed to near Monday's low, losing 214 points on August 22 and over 290 points from the weekly high. Despite the formation of a long red candle, the index defended all short- and medium-term moving averages, as well as the midline of the Bollinger Bands. Hence, if the index rebounds, the 25,000 level is the one to watch, followed by 25,150 as a crucial hurdle. However, immediate support is placed at 24,850 (Friday’s low), as a break below this level may lead bears into the bullish gap area of August 18, according to experts.

Here are 15 data points we have collated to help you spot profitable trades:

1) Key Levels For The Nifty 50 (24,870)

Resistance based on pivot points: 25,024, 25,077, and 25,164

Support based on pivot points: 24,852, 24,799, and 24,712

Special Formation: The Nifty 50 formed a big bearish candle on the daily charts, signaling a negative trend, but the trading volume was lower compared to the previous session. Moreover, the index remained above all key moving averages and the midline of the Bollinger Bands, which is a positive sign. While the bullishness in the histogram faded slightly, the MACD still maintained a bullish crossover and moved closer to the zero line. The RSI bent down and fell to 50.59 but remained in the upper band with a positive crossover. This indicates that the broader trend remains intact, though momentum has weakened a bit.

2) Key Levels For The Bank Nifty (55,149)

Resistance based on pivot points: 55,578, 55,729, and 55,975

Support based on pivot points: 55,087, 54,935, and 54,690

Resistance based on Fibonacci retracement: 55,548, 55,945

Support based on Fibonacci retracement: 54,392, 53,392

Special Formation: The Bank Nifty also formed a long red candle and traded below the 10-, 20-, and 50-day EMAs, as well as the midline of the Bollinger Bands on the daily timeframe—indicating nervousness. The banking index is approaching the 100-day EMA (55,000) and the August low (54,900). A decisive fall below these levels could further strengthen the bears. The RSI dropped to 40.52 with a negative crossover, while the histogram's bullish bias faded slightly. However, the MACD still shows a positive crossover, albeit below the zero line. This indicates caution, with a slight bullish undertone yet diminishing momentum.

3) Nifty Call Options Data

According to the monthly options data, the maximum Call open interest was seen at the 25,000 strike (with 1.73 crore contracts). This level can act as a key resistance for the Nifty in the short term. It was followed by the 25,100 strike (1.06 crore contracts), and the 25,500 strike (1.058 crore contracts).

Maximum Call writing was observed at the 25,000 strike, which saw an addition of 1.13 crore contracts, followed by the 24,900 and 25,100 strikes, which added 64.86 lakh and 59.28 lakh contracts, respectively. The maximum Call unwinding was seen at the 24,400 strike, which shed 19,275 contracts, followed by the 24,200 and 24,100 strikes, which shed 18,750 and 8,475 contracts, respectively.

4) Nifty Put Options Data

On the Put side, the 25,000 strike holds the maximum Put open interest (with 73.34 lakh contracts), which can act as a key level for the Nifty. It was followed by the 24,500 strike (68.44 lakh contracts) and the 24,900 strike (64.49 lakh contracts).

The maximum Put writing was placed at the 24,900 strike, which saw an addition of 26.72 lakh contracts, followed by the 24,400 and 24,600 strikes, which added 21.8 lakh and 13.91 lakh contracts, respectively. The maximum Put unwinding was seen at the 25,100 strike, which shed 11.64 lakh contracts, followed by the 25,000 and 24,151 strikes, which shed 10.66 lakh and 8.38 lakh contracts, respectively.

5) Bank Nifty Call Options Data

According to the monthly options data, the 57,000 strike holds the maximum Call open interest, with 26.03 lakh contracts. This can act as a key resistance level for the index in the short term. It was followed by the 56,000 strike (25.95 lakh contracts) and the 55,500 strike (16.47 lakh contracts).

Maximum Call writing was observed at the 55,500 strike (with the addition of 9.39 lakh contracts), followed by the 56,000 strike (5.52 lakh contracts), and the 55,300 strike (4.82 lakh contracts). The maximum Call unwinding was seen at the 54,000 strike, which shed 21,385 contracts, followed by the 54,500 and 53,500 strikes, which shed 15,610 contracts, and 9,065 contracts, respectively.

6) Bank Nifty Put Options Data

On the Put side, the maximum Put open interest was seen at the 57,000 strike (with 12 lakh contracts), which can act as a key level for the index. This was followed by the 55,000 strike (10.84 lakh contracts) and the 54,000 strike (10.01 lakh contracts).

The maximum Put writing was observed at the 54,000 strike (which added 1.49 lakh contracts), followed by the 53,500 strike (1.08 lakh contracts) and the 55,300 strike (88,620 contracts). The maximum Put unwinding was seen at the 55,800 strike, which shed 3.51 lakh contracts, followed by the 56,000 and 55,500 strikes, which shed 2.82 lakh and 2.15 lakh contracts, respectively.

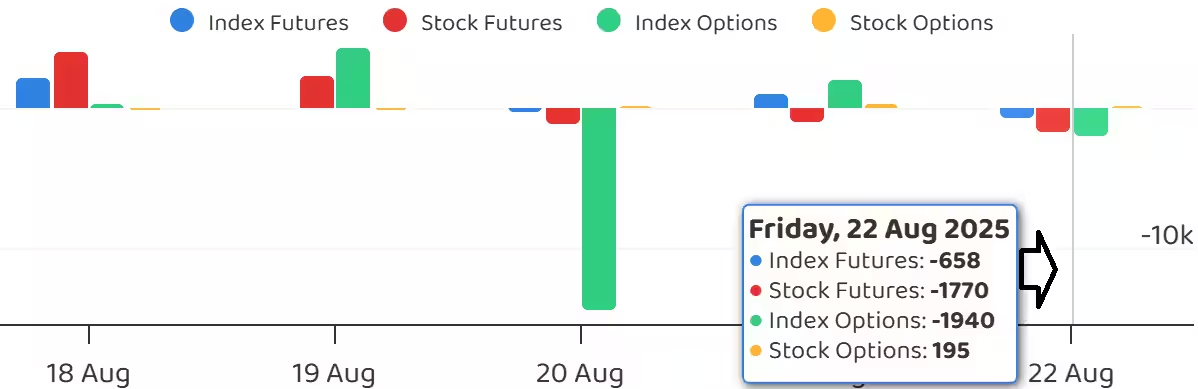

7) Funds Flow (Rs crore)

8) Put-Call Ratio

The Nifty Put-Call ratio (PCR), which indicates the mood of the market, declined sharply to 0.73 on August 22, compared to 1.09 in the previous session.

The increasing PCR, or being higher than 0.7 or surpassing 1, means traders are selling more Put options than Call options, which generally indicates the firming up of a bullish sentiment in the market. If the ratio falls below 0.7 or moves towards 0.5, then it indicates selling in Calls is higher than selling in Puts, reflecting a bearish mood in the market.

9) India VIX

The fear index, India VIX, remained below all key moving averages for the fourth consecutive session, though it gained 3.12 percent to 11.73 on Friday. This still supports the bulls and reflects stable market conditions.

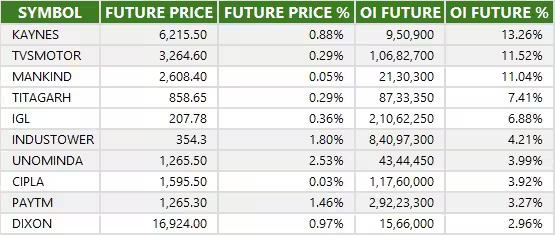

10) Long Build-up (28 Stocks)

A long build-up was seen in 28 stocks. An increase in open interest (OI) and price indicates a build-up of long positions.

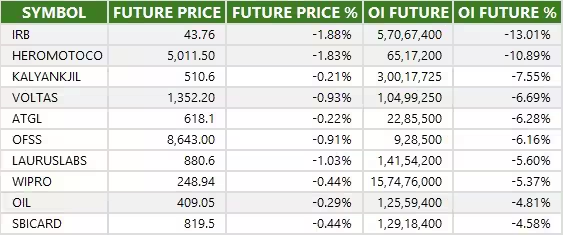

11) Long Unwinding (84 Stocks)

84 stocks saw a decline in open interest (OI) along with a fall in price, indicating long unwinding.

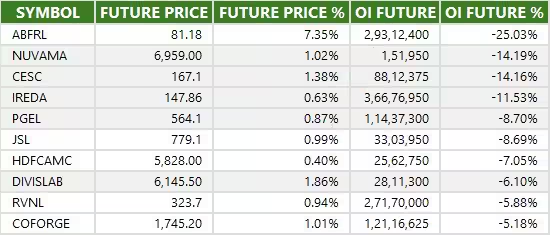

12) Short Build-up (63 Stocks)

63 stocks saw an increase in OI along with a fall in price, indicating a build-up of short positions.

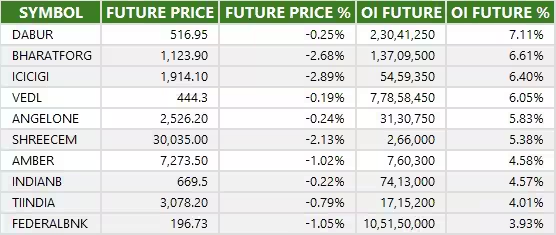

13) Short-Covering (43 Stocks)

43 stocks saw short-covering, meaning a decrease in OI, along with a price increase.

14) High Delivery Trades

Here are the stocks that saw a high share of delivery trades. A high share of delivery reflects investing (as opposed to trading) interest in a stock.

15) Stocks Under F&O Ban

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Stocks added to F&O ban: Titagarh Rail Systems

Stocks retained in F&O ban: PG Electroplast, RBL Bank,

Stocks removed from F&O ban: Nil

0 Comment