31 Mar , 2022 By : Kanchan Joshi

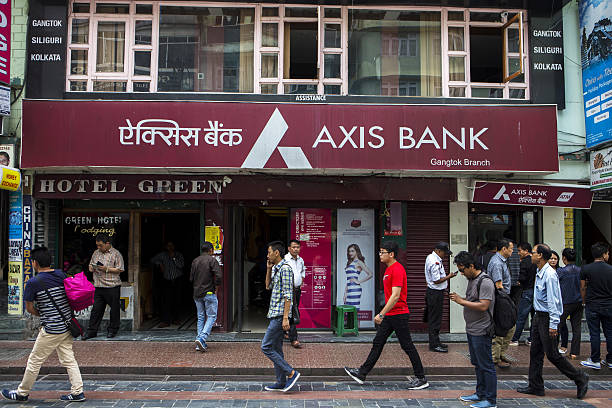

Axis Bank will acquire US-based Citi's consumer business in India for Rs12,325 crore in one of the largest deals in the Indian financial services space, in a bid to bulk up its credit card and retail businesses, and help close the gap with larger peers like ICICI Bank and HDFC Bank. Shares of Axis Bank have outperformed by rising about 10% in 2022 (YTD) so far as compared to a 2% rise in Nifty Bank index.

Axis Bank and Citi, signed a definitive agreement for the sale, which will involve the third largest private lender taking over Citi's credit cards, personal loans and wealth management businesses that are focused on the affluent segment.

“The management sees the acquisition to breakeven in CY24 (almost FY25); this implies limited upside till then, with potential capital raise in 12-15 months. We maintain our Buy rating with a target price of Rs1,040," Jefferies said in a note.

The regulatory approvals for the deal are expected in nine months, after which the payment will be made and a complex integration process will begin.

“Axis is a strong banking franchise with competitive cost of funds, robust distribution channel, solid presence in payment ecosystem and improving digital capabilities. Acquisition of Citi’s India retail business should strengthen Axis’ competitive positioning as it gets a foothold in the affluent segment. Axis is our top pick in private banks with target price of Rs997," said analysts at Ambit.

Those at PhillipCapital are also bullish on the bank stock as they believe Citibank’s consumer portfolio complements Axis bank’s ambition to 'retailize' and ‘granularize’ its loan book. “Ability of the bank to improve sustainable margin is key for further re-rating. We believe the improvement in return ratio will be on the back of lower credit cost," the brokerage added.

0 Comment