03 Sep , 2022 By : Kanchan Joshi

Share Market indices fell flat awaiting US jobs data which could give indications of the Federal Reserve's rate hikes in the future. Reports indicate that 285,000 US jobs were added last month and the unemployment figure stayed around 3.5 percent. Investors fear that strong employment figures could indicate further rate hikes by the Federal Reserve.

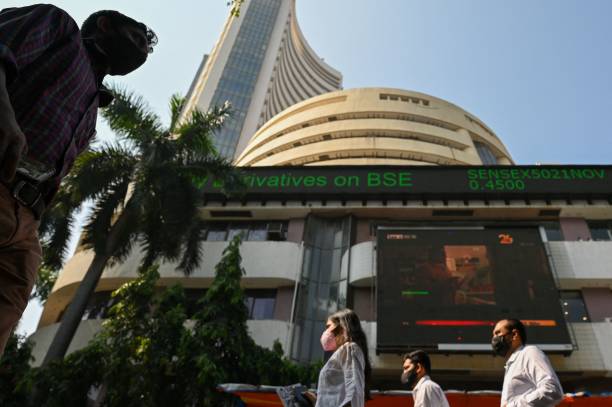

While National Stock Exchange's Nifty 50 index dropped 0.02 percent to reach the 17,539 mark, Bombay Stock Exchange's Sensex rose 0.06 percent to reach the 58,803.33 mark.

Adani Enterprises, the flagship company of the Adani group, climbed 118.75 points to hit a record high of 3,352 after its inclusion in the Nifty 50 index.

On the other hand, Shree Cement fell 2.3 percent and reached the 21,088.4 mark. It was one of the worst drags on the Nifty 50 index and after the fact, NSE said that the stock would be removed from the NIFTY 50 index from 30 September.

"Markets are technically in an overbought territory. Headlines over China-Taiwan will keep markets under pressure and U.S. jobs data will be crucial to watch out for," news agency Reuters quoted Prashanth Tapse - research analyst, senior VP (research), Mehta Equities Ltd as saying.

Tapse adds, "Domestically, data remains strong. We will see inflation cooling down, with crude prices below $90 a barrel, and that will help the markets to stabilise,"

Till Thursday, $776.86 million worth of foreign investor inflows pumped with around $534.34 million coming in the trading session alone.

J.R. Varma, member of the monetary policy committee, has said the success of the Reserve Bank of India's interest rate hikes to control inflation is not yet clear, and the pace of rate adjustment will depend on state of the economy.

0 Comment