03 Jan , 2022 By : Kanchan Joshi

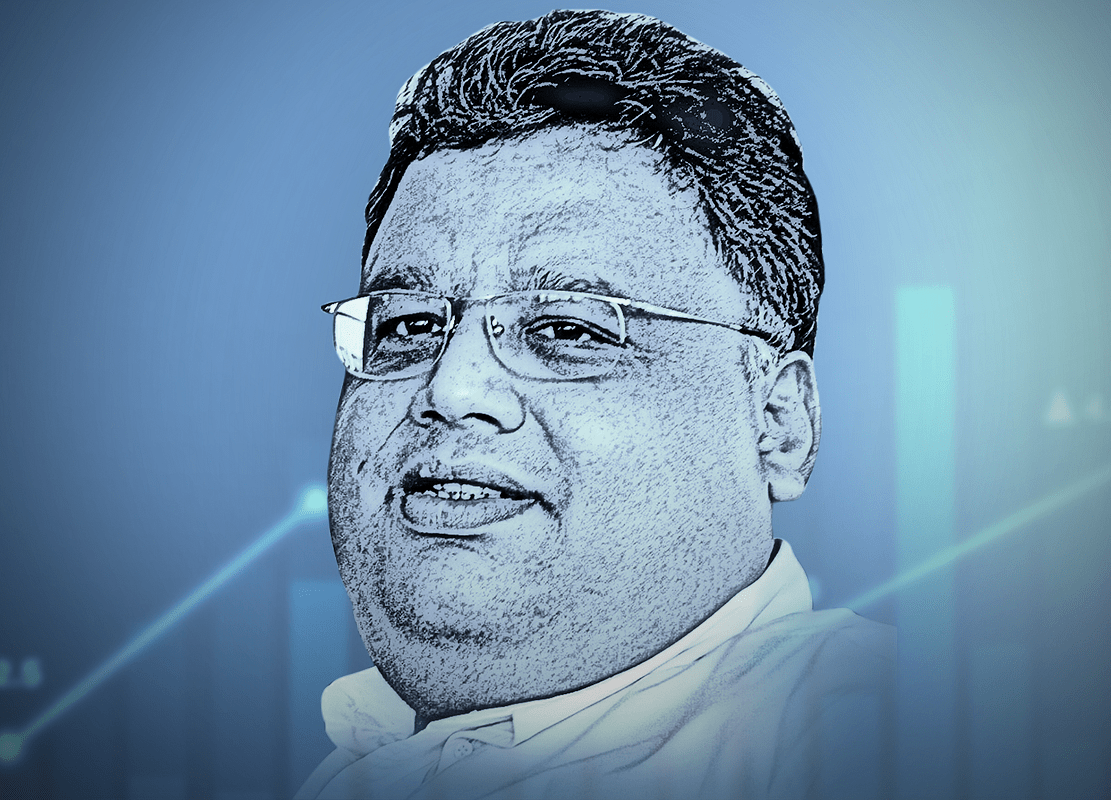

Rakesh Jhunjhunwala portfolio today: Canara Bank shares are one of the 3 new stocks that Big Bull Rakesh Jhunjhunwala added in July to September 2021 quarter. This Rakesh Jhunjhunwala stock has been under selloff heat after making closing high of Rs244.25 on NSE in 2021. However, Canara Bank share price has started showcasing upside swing and experts are highly bullish on the counter as they expect sharp upside in Nifty Bank index this week.

According to stock market experts, Nifty Bank index may give sharp upside movement this week and Canara Band shares could be a major beneficiary of the fresh buying taking place this week. They said that Rakesh Jhunjhunwala portfolio stock may go up to rs250 in near term and advised investors to add this PSU banking stock in their portfolio.

Advising stock market investors to buy Carana Bank share; Sumeet Bagadia, Executive Director at Choice Broking said, "Rakesh Jhunjhunwala portfolio stock is currently around Rs200 levels and in last week trade it has shown some signs of bounce back as well. On chart pattern too, the stock looks positive and one can buy this counter at current market price for one month target of Rs225 to Rs230 maintaining stop loss at Rs185 levels." The Choice Broking expert said that after breaching this Rs225 to Rs230 levels, the stock may further go up to Rs250 apiece levels.

On fundamentals of Canara Bank shares; Anand Dama, Research Analyst at Emkay Global said, "Despite moderate Y-o-Y credit growth of 6 per cent and soft NIMs, Canara Bank reported a strong beat on PAT at Rs13.3bn against our estimate of Rs8.8bn, mainly helped by higher treasury income, contained provisions and cash recovery from DHFL. The bank has guided for 7-8 per cent loan growth and lower slippages of near 1.7-1.8 per cent in FY22, which, coupled with the transfer of NPAs to NARCL, should lead to a further reduction in GNPAs." Anand Dhama of Emkay Global also advised investors to buy Canara Bank shares for long-term.

Rakesh Jhunjhunwala holding in Canara Bank

As per to Canara Bank shareholding pattern for Q2FY22 quarter, Rakesh Jhunjhunwala holds 2,90,97,400 Canara Bank shares, which is 1.60 per cent of the total issued paid up capital of the PSU bank.

0 Comment