05 Jul , 2021 By : Kanchan Joshi

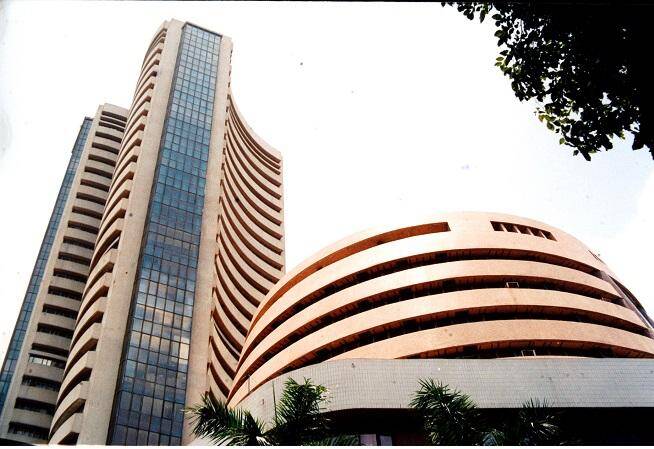

MUMBAI: Markets are likely to be steady on Monday while trends in SGX Nifty suggest a positive opening of Indian benchmark indices. On Friday, the BSE Sensex ended at 52,484.67, up 166.07 points or 0.32%. The Nifty ended at 15,722.20, up 42.20 points or 0.27%.

Asian stocks were steady early Monday after US shares climbed further on speculation the Federal Reserve has scope to continue providing substantial stimulus support.

Oil edged lower amid an Opec spat. Japanese shares slipped while South Korea and Australia inched up.

The S&P 500 reached a record for a seventh day Friday after a US jobs report signaled the economy is gaining steam but not at a pace that would prompt the central bank to taper stimulus quickly.

Vodafone Idea Ltd has asked its lenders to give up their first charge on the collateral so that the cash-strapped telco can raise fresh funds from investors, according to a Mint report. The company, saddled with liabilities of Rs1.8 trillion, is looking to raise nearly Rs25,000 crore from international investors using the securities placed as collateral with banks. It has borrowed close to Rs23,080 crore from banks and financial institutions.

HDFC Bank on Saturday said its board has given its approval to buy more than 3.55 crore shares in group firm HDFC ERGO General Insurance Company for over Rs1,906 crore from the parent company Housing Development Finance Corporation (HDFC).The country's largest mortgage lender HDFC Ltd on Friday said it earned Rs263 crore as profit on sale of investments during the first quarter of the current financial year.

In primary markets, India Pesticides will be listed today. The Rs800-crore public issue was subscribed 29 times.

Oil was around $75 a barrel amid an Opec dispute that cast doubt on a deal that may temper prices. Saudi Arabia and the United Arab Emirates are at odds.

Elsewhere, China’s stock market open will be in focus in case the move causes jitters by again highlighting Beijing’s push to curb the influence of the nation’s largest technology companies.

0 Comment