19 Jun , 2021 By : Kanchan Joshi

Travel and hospitality technology services provider RateGain Travel Technologies Pvt. Ltd is planning an initial public offering (IPO), two people aware of the development said. With this, RateGain joins a list of companies headed for the capital markets in the coming quarters.

In 2015, private equity firm TA Associates invested $50 million in the company, which provides software-as-a-service products. The firm, which was founded in 2004, claims its services are used by more than 25 out of the top 30 online travel agencies, airlines, hotel chains, and tour operators in India.

“The tech firm has picked up two banks to start work on its IPO. It has appointed Kotak Mahindra Capital and IIFL to manage the process and more will be added later. They might raise around Rs1,200 crore through the IPO, which will be a mix of primary and secondary share sale. TA Associates is an investor and will look to sell down part of its stake," one of the two people mentioned above said on condition of anonymity.

RateGain helps travel and hospitality firms in revenue management, e-distribution, and brand engagement. It claims to support more than 250,000 hotel properties globally, by providing 240 billion rate and availability updates and handling more than 30 million bookings every year.

The company’s plans make it the third Indian company from the travel sector to seek a public listing, at a time the industry hopes to emerge from the pandemic on the back of mass vaccination programmes globally.

Low-fare carrier Go Airlines (India) Ltd of the Wadia Group filed its draft prospectus with the market regulator last month for an initial share sale to raise up to Rs3,600 crore. Online travel portal ixigo also aims to go public and is expected to raise Rs750 crore through a primary issue of shares as part of its Rs1,500-1,800 crore IPO expected later this fiscal, Mint reported on 24 May.

Online travel portal EaseMyTrip (Easy Trip Planners Ltd) raised Rs510 crore through its IPO in March.

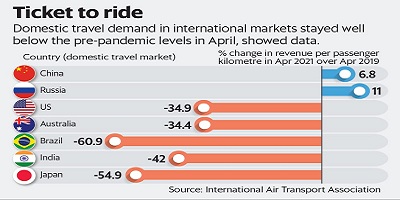

The International Air Transport Association (Iata) in May said global domestic travel demand improved in April 2021 compared with the prior month, though it remained well below pre-pandemic levels, even as global passenger travel continues to struggle because of government-imposed travel curbs.

China’s domestic traffic returned to pre-crisis levels of growth, it said, adding that the US domestic market is expected to make a full recovery by the end of this year or early 2022.

“RateGain serves travel and hospitality providers across the globe. So, they are well insulated from the impact of the second covid wave here in India. With vaccinations picking up, especially in the West, demand for travel and hospitality will bounce back strongly and companies such as RateGain will benefit from that. We have already seen a few budget airlines list in the US in the past few months. So investor demand for the sector is clearly coming back," the second person mentioned above said on condition of anonymity.

Emails sent to RateGain and TA Associates remained unanswered till press time.

With its IPO plans, RateGain also joins several tech firms that plan to list on Indian stock exchanges in the coming months. These include Paytm and Zomato, which plan to raise around Rs22,000 crore and Rs8,250 crore, respectively. Others in queue include insurance marketplace PolicyBazaar and financial services provider MobiKwik.

0 Comment