18 Jan , 2023 By : Monika Singh

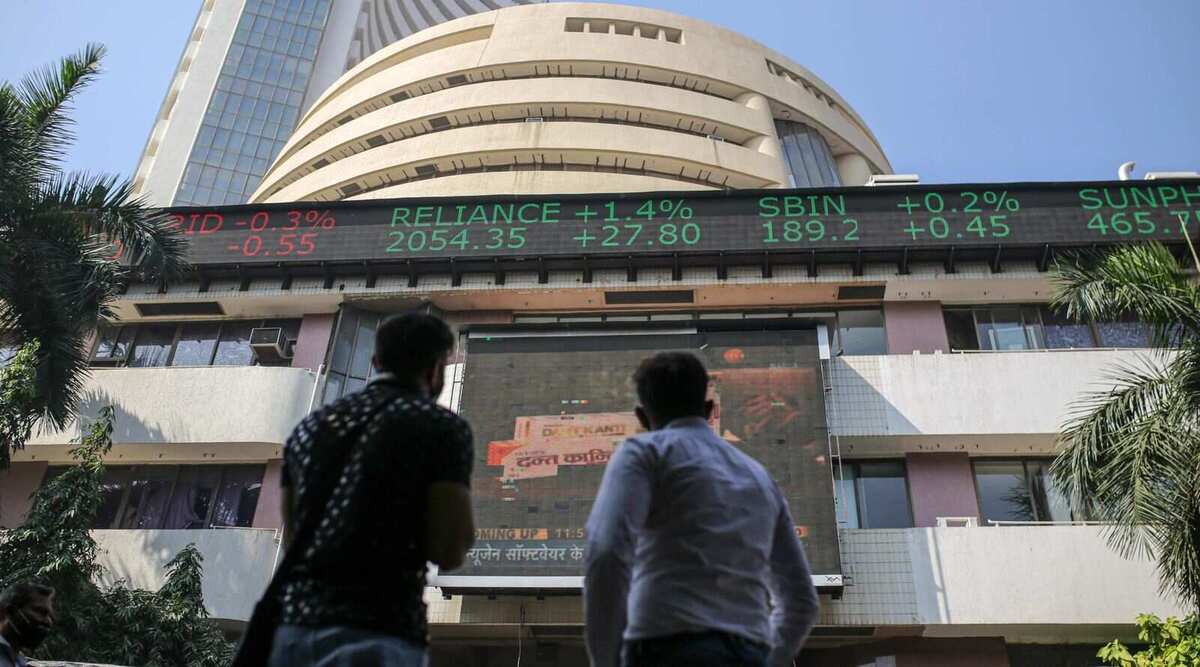

Domestic indices opened on a flat note with a positive bias on Wednesday, January 18. The 30-share BSE benchmark rose 8.82 pts or 0.01% to 60,664.54 and the NSE Nifty 50 rose 12.70 points or 0.07% to 18,066.00. The top gainers of the Nifty were Tata Steel, Hindalco, Wipro, HCL Tech and SBI Life while HDFC Life, Tata Motors, UltraTech Cement, State Bank of India and Adani Entreprises were the top losers.

Tata Metaliks shares rose 1.81% to Rs 847.75 after the Tata Group company reported a profit of Rs 9.48 crore for the December FY23 quarter, falling 74% on-year, dented by weak operating performance. Input cost and finance cost hit the bottom line. However, revenue from operations grew by 14.5% on-year to Rs 790.23 crore for the quarter. On the other hand, ICICI Lombard General Insurance Company shares fell 6% to Rs 1174.35 after the company recorded a 29% on-year fall in standalone profit at Rs 220.63 crore for the quarter ended December FY23. Net premium income grew by 4.3% on-year to Rs 9,464.5 crore in Q3FY23.

In the sectoral indices, Nifty Bank was down 0.02%, Nifty Pharma rose 0.30%, Nifty IT was up 0.33%, Nifty PSU Bank was down 0.73% while Nifty Auto was down 0.20%. The volatility index India VIX was up 0.35%.

China’s Shanghai composite index fell 0.63 points or 0.02% to 3,223.62 on Wednesday, Hong Kong’s Hang Seng dipped 32.65 points or 0.15% to 21,544.99 while Japan’s Nikkei 225 rose 463.77 points or 1.77% to 26,602.45. The US markets concluded Tuesday’s session on a mixed note. The Dow Jones Industrial Average (DJIA) crashed 1.14% or 391.76 pts to 33,910.85, the S&P 500 fell 8.12 pts or 0.20% to 3,990.97 while the tech-heavy Nasdaq rose 15.96 pts or 0.14% to 11,095.11.

Foreign institutional investors (FII) bought shares worth a net Rs 211.06 crore and domestic institutional investors (DII) purchased shares worth a net Rs 90.81 crore on Tuesday, January 17, 2023, according to the data available on NSE.

The National Stock Exchange has put Delta Corp, Indiabulls Housing Finance, Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC), L&T Finance Holdings and Manappuram Finance Ltd stocks under its F&O ban list for Wednesday, 18 January. According to the NSE, the stocks mentioned above are prohibited in the F&O sector because they have exceeded 95% of the market-wide position limit (MWPL). During the F&O ban period, no new positions are permitted for F&O contracts in these stocks.

0 Comment