04 Jul , 2022 By : Monika Singh

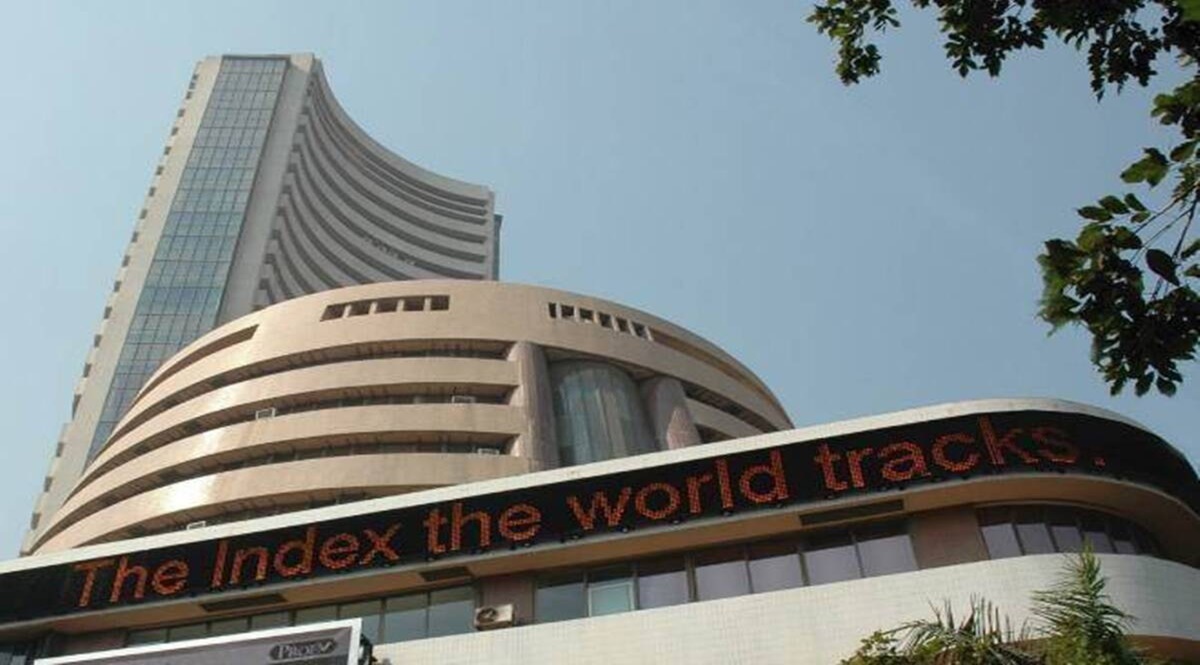

Share Market News Today | Sensex, Nifty, Share Prices LIVE: Domestic stock markets began this week’s trade flat, dancing between marginal gains and losses. S&P BSE Sensex opened in the green but soon slipped into the red, hovering around 52,900. NSE Nifty 50 index was still above 15,700. Bank Nifty was up 0.50% along with broader markets. India VIX was up 3% touching 22 levels. IndusInd Bank stock was the top gainer on Sensex, followed by Powergrid, Hindustan Unilever, and Sun Pharma. Tata Steel was the top laggard, accompanied by M&M, and TCS.

The mega HDFC and HDFC Bank merger has been given the green light by the stock exchanges. In a filing, HDFC Bank informed investors that it has received an observation letter with ‘no adverse observations’ from BSE Limited and an observation letter with ‘no objection’ from the National Stock Exchange of India Limited, both dated July 2, 2022. However, it must be noted that the merger is yet to get a nod from the Reserve Bank of India, Competition Commission of India, and the National Company Law Tribunal. Shareholders and creditors of both HDFC and HDFC Bank are also yet to give their consent for the merger. Earlier in April this year, India’s largest private sector lender HDFC Bank agreed to take over the biggest domestic mortgage lender in a deal valued at about $40 billion.

The Federal Reserve will release the minutes of its June monetary policy meeting, which investors around the world will be keenly awaiting. Corporate results season for the June quarter will shortly begin, and the market may soon start displaying some stock-specific action. Investors ought to pick companies with solid fundamentals and pay close attention to management comments. Immediate support and resistance for Nifty are 15,600 and 16,000 respectively. Immediate support and resistance for Bank Nifty are 33,000 and 34,000 respectively,”

“Market movements this month are likely to be significantly influenced by the Q1 results starting with TCS's results on 8th July. More than the actual numbers, the market will be focused on guidance. Similarly, in financials particularly banking, the market will be keen to know the trends in credit growth rather than the decline in treasury income, which is already known. The buoyancy in GST collections and June auto numbers indicate that economic recovery is gaining momentum, in spite of many headwinds, and this bodes well for the market's performance in H2 FY23. In the present context of high near-term uncertainty, the best strategy for investors would be to buy high-quality large-caps in a calibrated manner and wait with patience.”

“Nifty on daily charts has formed a bullish hammer pattern though its placement is not ideal. Nifty has a fair chance of extending this upmove. A breach of 15927 could take it to the gap resistance of 16172, which may be tough to breach. In case this is breached, the upward momentum will accelerate,”

0 Comment