17 Aug , 2022 By : Monika Singh

Kotak Mahindra Bank on Tuesday raised its marginal cost of funds-based lending rates (MCLR) by 5 basis points (bps) across all tenures. The bank’s one-year MCLR now stands at 8.10%, effective August 16.

This is the seventh consecutive increase in the MCLR by the bank with steeper hikes of 25 bps in May and an increase of 20 bps each in June and July. The bank’s shorter-tenure lending rates now stand in the range of 7.35-7.95% while longer-tenure loan rates are at 8.4% and 8.6%.

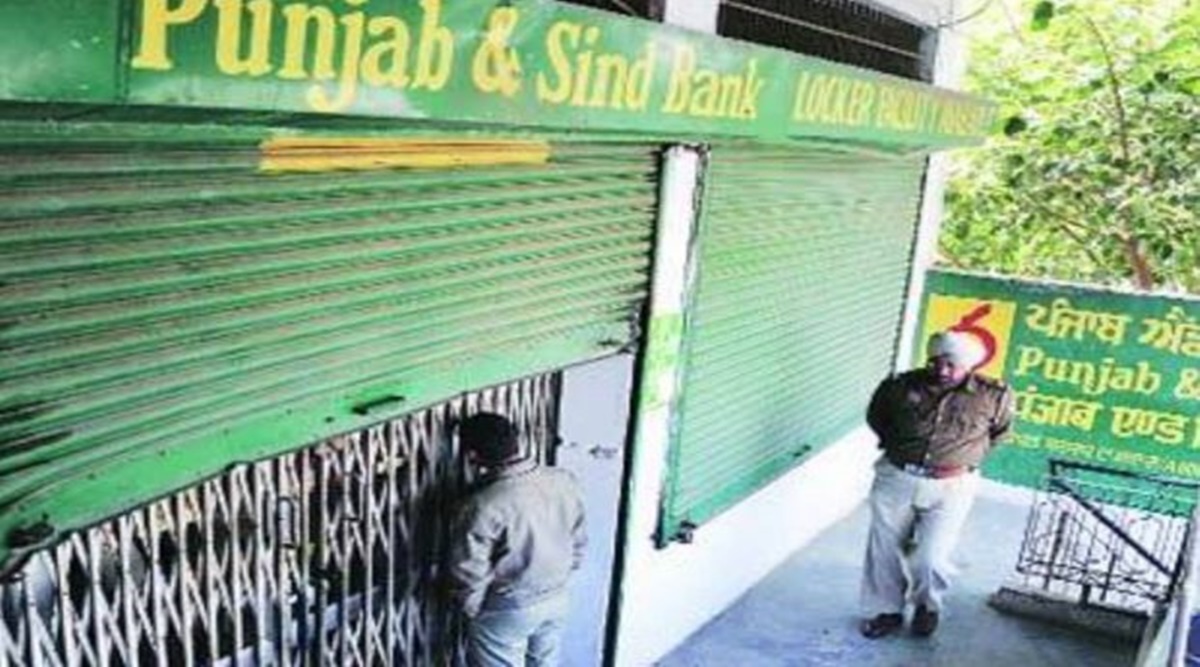

Public sector lender Punjab and Sindh Bank also raised its MCLR in the range of 5-10 bps across tenures. The bank has raised its one-year MCLR by 10 bps to 7.65% while shorter-term rates are in the range of 6.85-7.30%.

Banks are increasing lending rates since the Reserve Bank of India (RBI) has raised the repo rate. Earlier, State Bank of India raised its MCLR by 20 basis points (bps) across tenures. Bank of Baroda, ICICI Bank, Bank of India, Punjab National Bank and Yes Bank have hiked their MCLRs in the range of 5-10 bps.

In addition to raising lending rates, banks are also increasing their deposit rates. Bank of Baroda has launched a special deposit scheme offering interest rates of 5.75% and 6% for 444-day and 555-day tenures, respectively. The scheme is valid till December 31, 2022 on retail deposits of below Rs 2 crore.

SBI has also increased interest rates on domestic terms deposits of some maturities.

0 Comment