20 Jan , 2022 By : monika singh

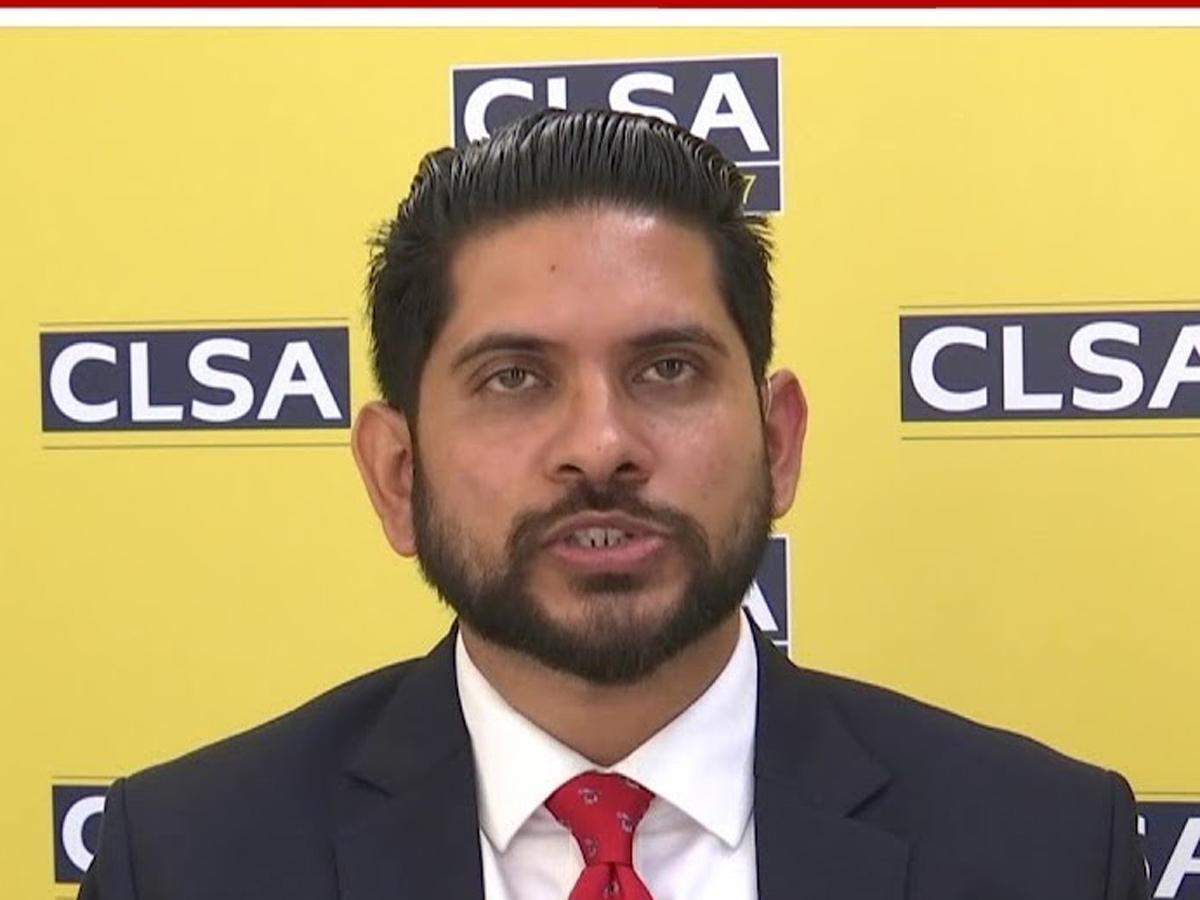

FII money will be important and may be more so if this DII liquidity dries out as a result of debt yields improving in the near term,” says Vikash Kumar Jain, Investment Analyst, CLSA.

In one of your recent notes you have mentioned that you foresee banks as well as Reliance Industries NSE -1.60 % driving year on year growth in market earnings in FY23. Where within Reliance do you be believe the bigger disruption is happening? What is it that makes the case stronger for the big to get bigger and better in the years to come?

I would not like to be stock specific but clearly it is one of the few conglomerates which does not really get impacted by disruption; if anything, it could be the beneficiary because it is there in all the themes over there. So over the longer term, if you look at most of the important themes which are playing out – be it technology, ecommerce, organised retailing, green energy as well as green inflation – it could be a beneficiary of that broadly.

So, it is in that stock, simple near term earnings growth is incremental. There are about 10 names which make up only about one-third of Nifty and which contributes 80% of that incremental profit growth and that includes some large banks and also some commodity names. In fact, five of those names are featured in our focussed portfolios. We have a focused portfolio where we look at about 12 stocks which includes three banks and three commodity names. So, there it a very clear preference of being overweight on banks and commodities. It is very clearly underweight IT and consumption.

Also Read: What will drive the market in 2022?

Among the defensives, we like pharma and utilities much more than IT and consumer staples. We should not forget that we are starting the year with things which are not on our side. It is not an equivocal year where one can bang the table about what is going to happen. It is a year where there will be a balancing act. Right now the big worry is that both the absolute and relative valuation of Nifty are at levels which historically has not given us great returns.

The consumption sentiment not being that correct, those are the two big risks when we start the year. The balancing factor is that Nifty is the best earnings growth story amongst large markets in the world other than Philippines which is not that bigger a market and that should in a way offset some of that valuation issues. So there will be periods when defensives will get relevant because it is going to be a year of big sector rotation and not really a runaway move on the benchmark and if one were to look at defensives, pharma would be amongst the preferred ones for us.

The call is more to do with where expectations have run up, essentially looking at the kind of registration data etc. that we saw last year which was also boosted by state tax benefits which were given. So one has to be more selective in certain names, where we see clear consolidation benefit and new launches or new markets helping them and rather than a call on the cycle. We do not believe that we are in a booming real estate cycle which will pick up in a dramatic manner but yes both real estate and capex in general is going to see a gradual recovery that we favour. So that is our thought process.

Sometimes, like in pharma, some of these names can run ahead of themselves and that is where we see periods of consolidation. It is really to do with that call rather than saying that the cycle will turn prematurely as that is not what we are saying. I understand what you are saying from a perspective of affordability, but some of these interest rate sensitives can take a back seat during the period when rate hikes are happening and yields are rising and more so now when there is a clear linkage of repo rates to housing loans. So there could be more of a stock reaction rather than business slowdown per se.

Can we say that we should not really worry about a lot of liquidity withdrawal or liquidity contraction because 2021 was not a year where FII liquidity dominated. Rather, it was domestic liquidity which made all the difference. So, while money may have come in the IPO market, the FII liquidity was not humongous and we should not worry about it?

Well that is right but I will tell you why we cannot ignore it. If I were to look at the last six months on a rolling six month basis, at the end of December, FII net outflow was the lowest we have seen in the last 15 years, other than maybe two months after IL&FS and may be one month in January 2016. So other than those three months, we have to go around the GFC level to find this kind of selling by FIIs.

And so what is the worrisome environment over the next few months? As near term yields rise and if we see a few months of negative returns on the market, some of the domestic money could start shifting back to debt and lot of it came because there was very little return to be made in near term one year, two years kind of debt investments. That will change as liquidity tightens and if near term returns on equity markets is not that great, then that money could start shifting out.

Anyway if I were to look at a simple chart of percentage of holding of equity by Indian households, we have already hit all-time high at levels higher than 2007. We cannot take our eyes off that debt equity valuation, As that shifts, FII liquidity will be important for us to support the markets and even more so because this could also be the year when primary markets could be even more busy with a lot of the lock-ins coming up.

We estimate that a pretty big chunk of lock-in could come out and there could be more stake sales plus the normal primary IPOs as well. So FII money will be important and may be more so if this DII liquidity dries out as a result of debt yields improving in the near term as well.

0 Comment