10 Oct , 2022 By : Monika Singh

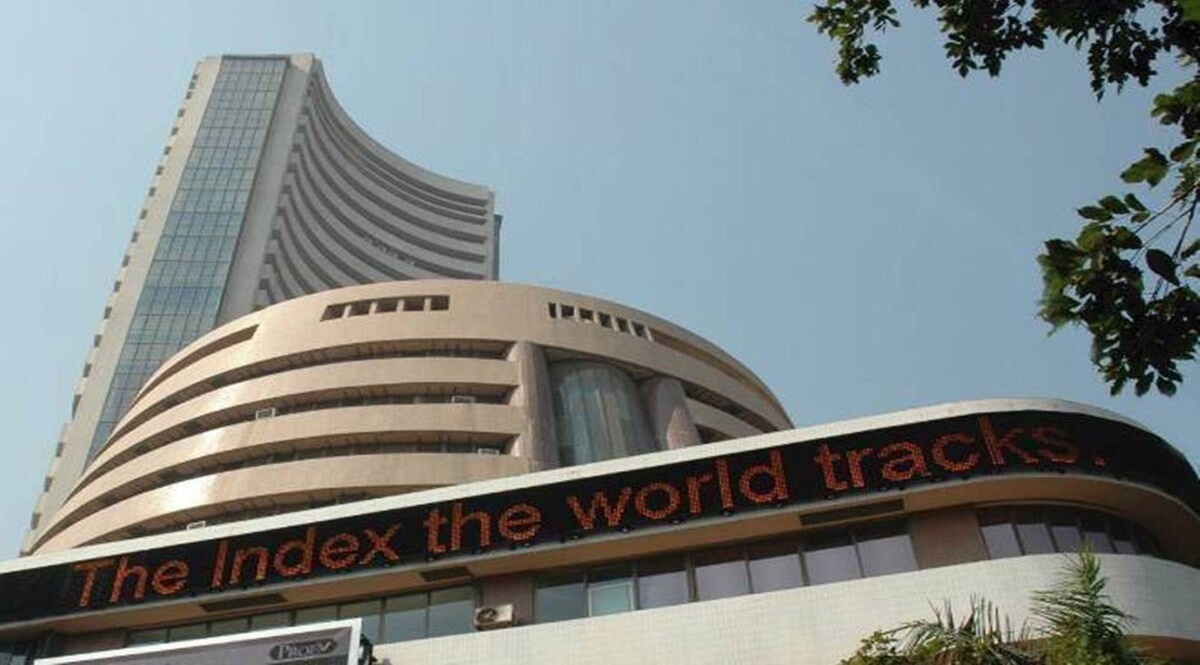

Share Market News Today | Sensex, Nifty, Share Prices LIVE: Domestic equity market benchmarks BSE Sensex and NSE Nifty 50 were trading over 1 per cent down on Monday, on the back of weak global cues. BSE Sensex fell 730 points or 1.25 per cent to 57,461, while NSE Nifty 50 tanked 237 points or 1.4 per cent to hover around 17,094. All the 30 BSE Sensex stocks were trading in red. Stocks of index heavyweights such as PowerGrid Corporation of India, Tata Consultancy Services (TCS), Dr Reddy’s Laboratories, Maruti Suzuki India, and Titan Company among others were top BSE Sensex losers. In the US, major stock indexes dropped more than 2% on Friday after data showed the unemployment rate declined in September, sparking fear that the Fed would continue hiking rates aggressively.

Nifty’s upside attempts on Friday fell painfully short of making any meaningful advance, a testimony to the level of distribution that was in play after Nifty had stormed into the 17400-500 territory. While this region was long discussed as an end in itself, at least for the near term, the breadth of upsides across stocks as well as indices had raised the hopes that the Nifty could continue marching ahead, while also encouraging talks of a new peak as Diwali approaches.

“17008 in Nifty and 38235 in Bank Nifty remain crucial levels to defend today. While the weekly setup remains bullish for both indices, intra-week volatility is expected to remain high due to US inflation data and the geopolitical scenario. Caution if VIX sustains above 22%. India VIX is suggesting no fear of the event however it is best to manage risk. We are in a classic 'buy on dip' setup with breakout placed above 17,500 & supports placed at 17,200 & 17,000.

Indian share market is expected to open in the red on Monday as early trends in SGX Nifty hinted at a negative opening for domestic equity benchmarks with a loss of 268 points. In the previous session, the Sensex declined 31 points to 58,191 while NSE Nifty 50 slipped 17 points to 17,315. According to analysts, while global investors will be keenly monitoring inflation figures in the US and China, Indian CPI print will be a key domestic factor to monitor. Further, IT companies will kick start the quarterly result season. Stock-specific swings will be evident. “We expect Nifty bulls to aim for 17500-17707 zone in the near term,”

0 Comment