08 Dec , 2021 By : monika singh

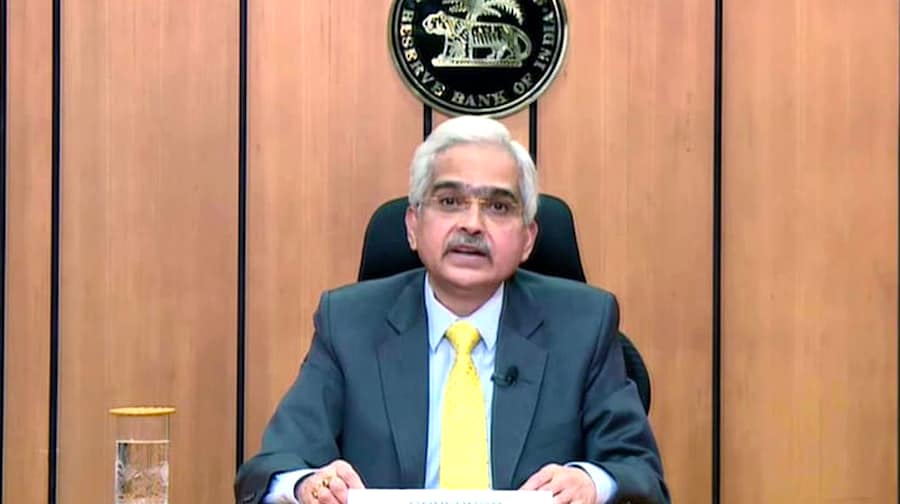

The Reserve Bank of India Governor Shaktikanta Das on Wednesday announced that the Monetary Policy Committee had opted to keep the rates unchanged in its latest meet.

The committee voted with a 5:1 majority to maintain an 'accommodative' stance to revive and sustain growth on a durable basis. The reverse repo rate has remained unchanged at 3.35%. Marginal Standing Facility (MSF) & bank rate too have remained unchanged, at 4.25%.

The prospects of economic activity are steadily improving. Given the slack in private consumption, continued support is required for a durable recovery," Das said. "Crude oil prices softening in November would alleviate domestic cost-push build-up. The recent reduction in taxes on petrol, diesel prices should support consumption demand," he added.

Growth outlook

The projection for real GDP growth has been retained at 9.5% in 2021-22 with 6.6% in Q3, & 6% in Q4. Real GDP growth is projected at 17.2% for Q1 of 2022-23 and at 7.8% for Q2 of 2022-23. On the inflation front, RBI has retained CPI projection at 5.3% in 2021-22. The inflation projection has been retained at 5.1% for Q3, 5.7% for Q4, and 5% for Q1FY23.

"The persistence of CPI inflation excluding food & fuel since June 2020 is an area of policy concern in view of input cost pressures that could rapidly be transmitted to retail inflation as demand strengthens," the governor said.

The RBI will continue to use variable rate reverse repo operations to absorb funds. It will conduct a VRRR auction of Rs 6.5 lakh crore in mid-December and Rs 7.5 lakh crore at the end of the month. 14-day VRRRs will continue to be complemented by longer-term 28-day VRRR auctions.

Amid the rising inflationary pressures and a recovering economy, many had touted the emergence of the Omicron variant of coronavirus as a possible hindrance to policy normalisation. Many had argued that it would be only prudent for the central bank to wait and assess the threat posed by the Omicron variant before hiking rates.

"Recent reductions in excise duty & state VAT on petrol and diesel should support consumption demand by increasing purchasing power. Govt consumption is also picking up from August, providing support to aggregate demand."

“We maintain our call for a reverse repo rate hike in February with the December meeting remaining a close call. We expect the RBI to continue on its path of normalisation with the reverse repo rate hike in February policy and repo rate hike in mid-2022-23," a Kotak economic research report said.

The RBI had last revised the policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

0 Comment