05 Aug , 2022 By : Monika Singh

RBI Monetary Policy meeting LIVE updates: The Reserve Bank of India Monetary Policy Committee is expected to hike repo rate in the range of 35-50 bps on Friday and push rates to at least above its pre-covid level of 5.15% in order to check high retail inflation. It would be the third consecutive hike in the repo rate in the last three months. The central bank may also gradually withdraw its accommodative monetary policy stance as from its last policy meeting, the environment has changed – domestic inflation saw moderation, global market fear of recession has ebbed and the liquidity has tightened. RBI had signaled earlier its decision to withdraw its accommodative stance and shift towards a neutral stance while prioritising controlling inflation over growth.

RBI Monetary Policy August 2022 Live Announcements: RBI MPC likely to hike repo rate by 35-50 bps; may withdraw accommodative stance

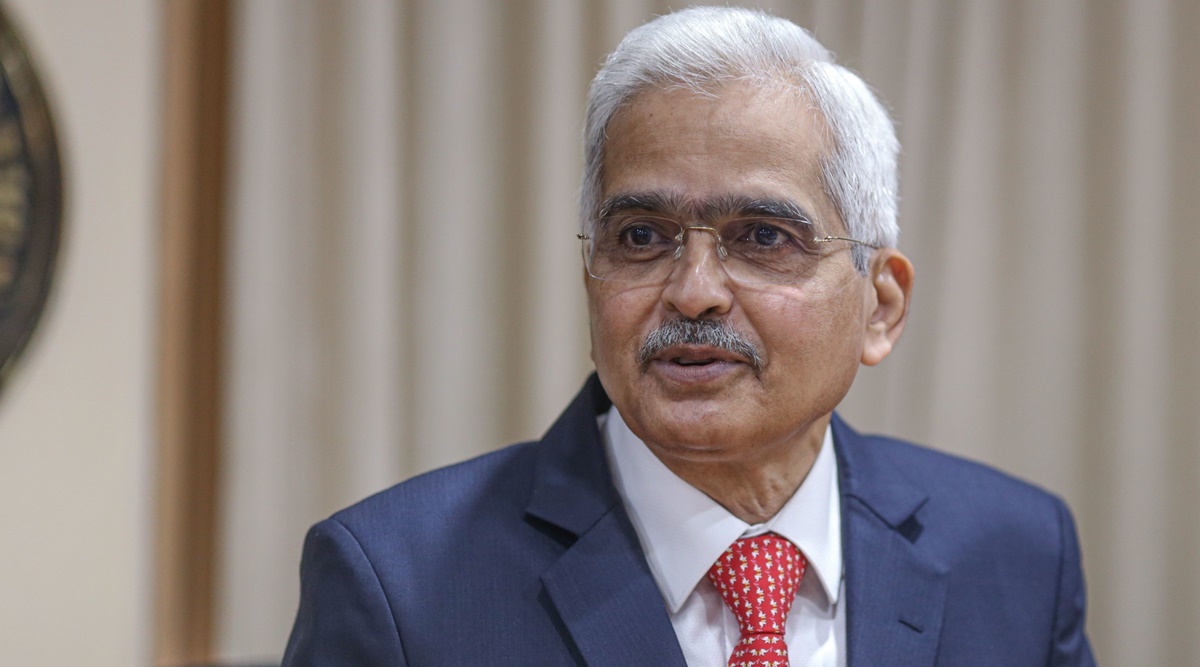

RBI Monetary Policy Committee (MPC) adjusts SDF to 5.15%. Indian economy naturally impacted by the global economic situation, said RBI Governor Shaktikanta Das.

RBI Monetary Policy Committee has hiked repo rate by 50 bps to 5.4%, third hike in a row. The repo rate is the rate at which the central bank of a country lends money to commercial banks.

The Bank Nifty index witnessed high volatility a day before the RBI Policy with movements on both sides. The RBI has raised rates twice since May and is expected to hike rates again to tame persistently high inflation in Asia's third-largest economy.

0 Comment