04 Aug , 2022 By : Monika Singh

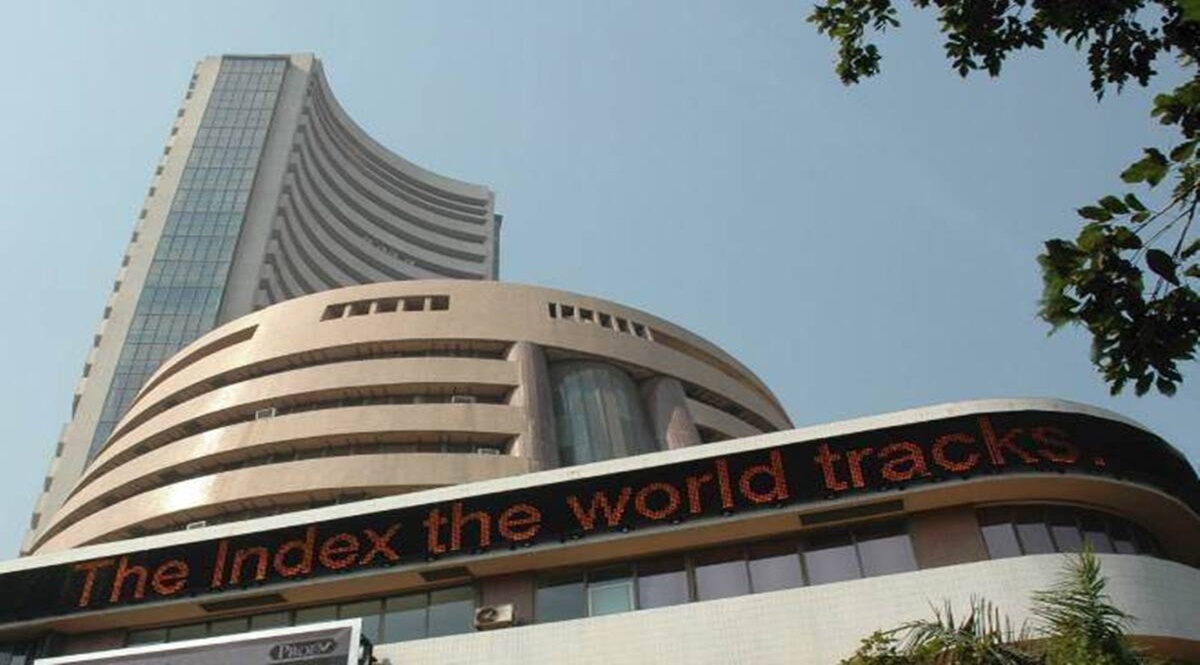

Share Market News Today | Sensex, Nifty, Share Prices LIVE: Domestic benchmark indices began trading on the weekly futures & options expiry session in the green. S&P BSE Sensex rose more than 350 points on Thursday morning to touch 58,700 while NSE Nifty 50 index neared 17,500. Bank Nifty was above 38,200 while India VIX was in the red, but still above 18 levels. Infosys was the top Sensex gainer, up 1.6%, followed by IndusInd Bank, Axis bank, TCS, and Asian Paints. NTPC was the top laggard, accompanied by SBI, Tata Steel, and Reliance Industries.

The Reserve Bank of India (RBI) could push the policy rate to pre-pandemic levels tomorrow with most economists expecting the Monetary Policy Committee (MPC) to hike rates by 50 basis points once again. 13 of the 27 economists surveyed by Bloomberg said they expect a 50 basis point hike that would take the repo rate to 5.40%, a level last seen in August 2019. The MPC will end its three-day deliberations tomorrow and eyes will be on RBI Governor Shaktikanta Das for guidance on inflation and further rate hikes.

“In the mother market of the US, markets are climbing many walls of worries including the US-China skirmishes arising from Nancy Pelosi's visit to Taiwan. Other markets are taking cues from the strong trend in the US market. In India, the FPIs turning buyers has changed the sentiments in favour of the bulls. The market momentum is so strong that it is overpowering negatives like higher valuations and rising trade deficit. If FPI buying sustains, the market may continue to remain resilient, but investors should exercise some caution. It makes sense to stick with high quality growth stocks. The strength in Nasdaq indicates that IT will continue to maintain the current uptrend,

S&P BSE Sensex rose more than 350 points or 0.60% on Thursday touching 58,700 during the initial minutes of trade. NSE Nifty 50 index was closing in on 17,500. Bank Nifty was above 38,200.

“Nifty recovered the early losses on Aug 03 and ended in the positive even as the world markets steadied after a minor panic over Pelosi’s visit to China and reactions from China. At close, Nifty was up 0.25% or 42.7 points at 17388.2. Nifty refuses to build on the intra-day losses, hence one more up-move seems pending. 17457-17530 could be the resistance band for the Nifty in the near term while a breach of 17155 could result in acceleration of downtrend,”

0 Comment