17 Mar , 2022 By : monika singh

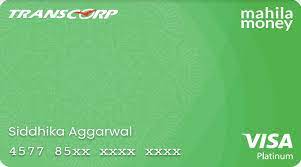

To help women entrepreneurs easily collect payments, loans and get incentives for transactions, Mahila Money, Visa and Transcorp have teamed up to launch Mahila Money Prepaid Card.

In a statement, Mahila Money said the prepaid card will help women entrepreneurs use digital payments more effectively.

Even as 80.7% of women in rural areas and 81% in urban areas have bank accounts, 55% of women still don’t actively use their bank accounts, according to the latest survey by the All-India Debt and Investment Survey (AIDIS). A survey by YouGov has revealed that nearly two-thirds of urban Indian women use digital modes of payments, but less than one-third leveraged internet banking.

The Mahila Money Prepaid Card would bridge the gap for community members who want the convenience of a bank account with added flexibility, safety and convenience, the statement said.

The prepaid card will make it easy for women entrepreneurs to collect payments digitally for their businesses and helps boost their working capital, as loans can be transferred directly into the card. Additionally, women will be offered incentives, rewards, and cashback from the Mahila Money ecosystem of partners.

Commenting on the launch of the prepaid card, Mahila Money founder Sairee Chahal said, “India is witnessing unprecedented adoption of digital financial products and mainstreaming of entrepreneurship.”

“As an organization committed to helping women succeed and build their financial and social capital, the Mahila Money Prepaid Card is a small but big step in the right direction. We believe that this partnership with Visa offers us the opportunity to create highly customized products for women entrepreneurs, a highly engaged and fast-growing segment of digital and financial services users” she added.

Sujai Raina, Vice President and Head of Business Development at Visa India, said, “At Visa, we believe it is our mission to work with our partners to uplift everyone–especially in India. We have a long history of supporting women entrepreneurs, a fast-growing yet underserved segment, whether through the iFundWomen and Visa grants program or coaching women micro-entrepreneurs across India on digital payments.”

Head of PPI Division at Transcorp Ayan Agarwal said, “As India’s premier non-bank card issuer, Transcorp takes pride in enabling financial independence for Indian women, and continuously strives to deliver success to its fintech partners through the optimization of stakeholder alignment.”

Manila Money said that first-time digital entrepreneurs, who are wary of using their bank accounts to set up online storefronts or collect payments will find the use of the card very easy.

A physical copy of the card is also available upon request, in addition to the digital card that will be available by default.

0 Comment