21 May , 2022 By : monika singh

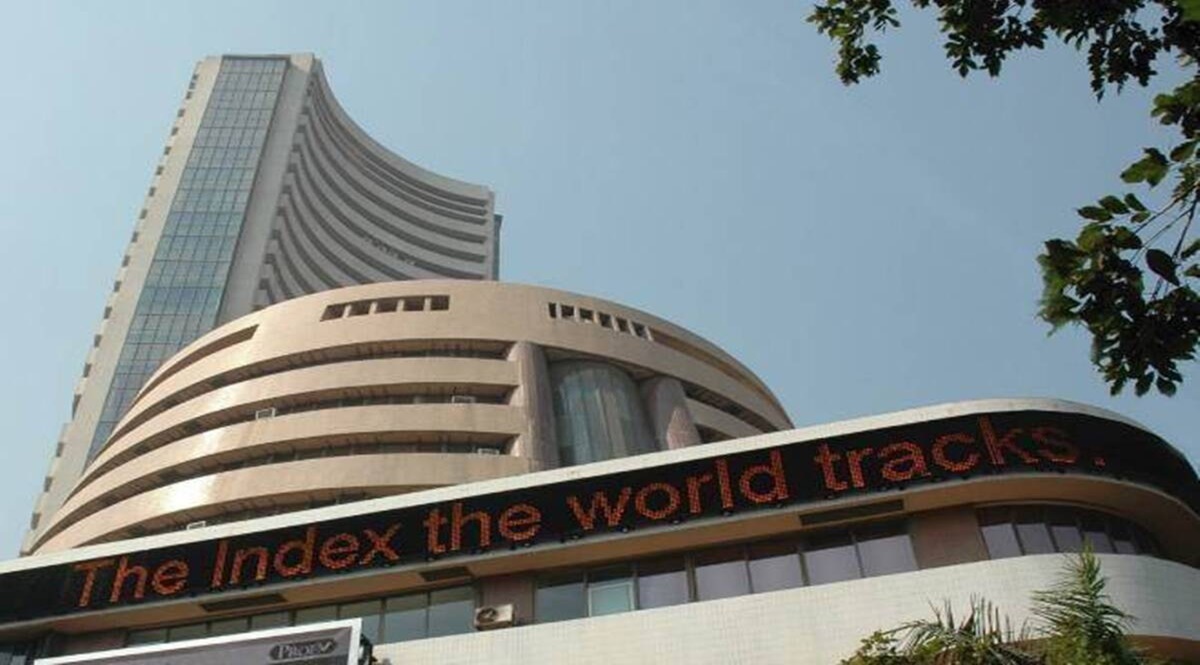

Stocks rebounded sharply on Friday and logged their biggest single-day gain since February 15. While the Sensex managed to settle above 54,000 levels, the Nifty50 reclaimed the 16,000 mark. The gains on Friday were mainly propelled by low-level buying in banking counters and a sharp rally in index heavyweight Reliance Industries.

Negating the overnight slump in US markets, investors tracked positive cues from Asian peers after the Chinese central bank slashed five-year rates by 15 basis points (bps). With Friday’s rally, both domestic benchmarks managed to snap their 5-week losing streak and ended the week higher by nearly 3?ch — also marking the best week since March 20 of this year.

After gaining as much as 1,604 points intra-day, the Sensex settled higher by 1,534.16 points, or 2.9%, at 54,326.39, and the broader Nifty-50 advanced 456.75 points, or 2.9%, to 16,266.15. Reliance Industries, HDFC Bank and ICICI Bank were the top contributors in the Sensex’s rally on Friday. Shares of Reliance Industries surged as much as 5.8% on Friday — marking its best single-day gain in six months.

“Global as well as Indian equities rebounded from their previous day’s sharp fall after Chinese central bank slashed five-year loan prime rate by 15 basis points to 4.45% to stimulate economic activity. Sentiments were also uplifted in domestic markets after positive commentary from finance minister Nirmala Sitharaman while addressing 7th annual meeting of New Development Bank (NDB) and cues from its Asian peers,” said Siddhartha Khemka, head of retail research, Motilal Oswal Financial Services.

Analysts further believe that with the markets ending at day’s high on Friday, it is likely that the overall sentiment could turn positive in the coming days. Additionally, visibility of short covering in the last few sessions and a fall in the short exposure by FIIs can drive the Nifty up to 16,800-17,000 levels in the coming weeks. “Looking at the stability in volatility above 22 and sharp fall in FIIs’ short exposure, we feel downsides should be limited. The recent low of 15,700 should be considered as good support. We believe short covering play should take the index towards 16,800-17,000 in coming weeks,” analysts at ICICI direct wrote in a note on a Friday.

In-line with the headline indices, the broader markets too ended higher on Friday. Both Nifty Midcap and Smallcap indices gained over 2% in the session. Sectorwise, all 15 sectoral gauges compiled by the NSE ended higher on Friday amid buying across the board, with the Nifty Metal and Pharma gaining 4.2% and 3.7%, respectively. Nifty Bank, too, ended higher by 2.9% on Friday. Overall, out of the 3,418 stocks traded on the BSE, 2,497 ended in the green on Friday.

0 Comment