21 Jul , 2022 By : Monika Singh

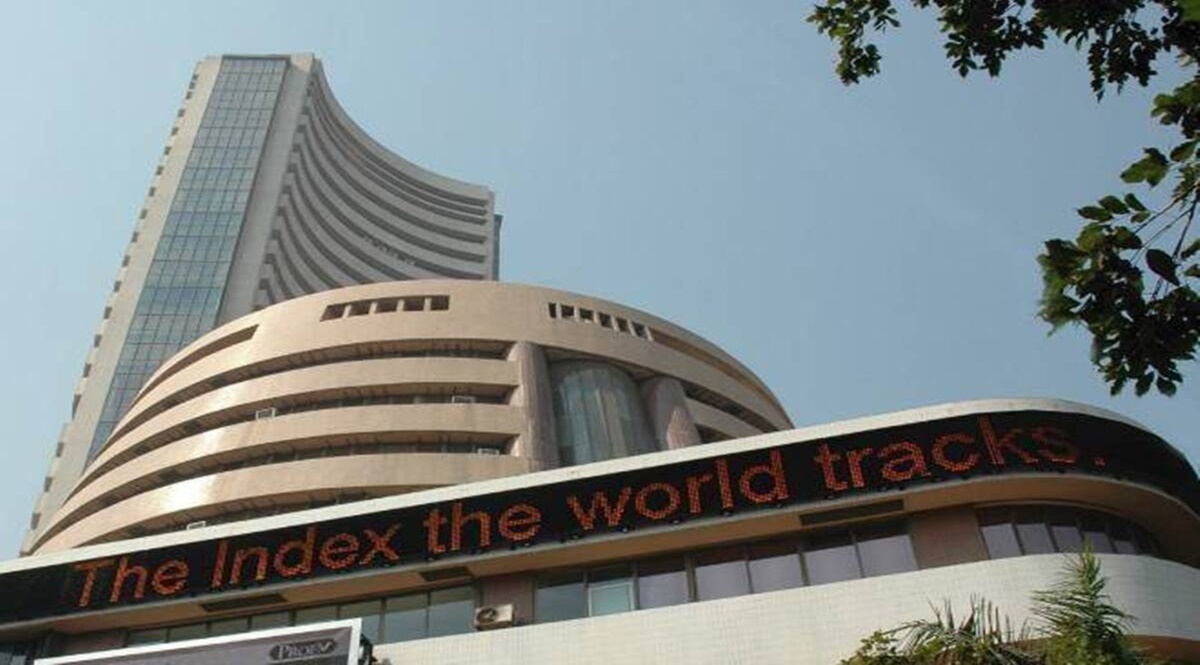

Share Market News Today | Sensex, Nifty, Share Prices LIVE: Indian equity markets are likely to open on a tepid note today on weekly F&O expiry amid mixed global cues. In the previous session, BSE Sensex rallied 630 points or 1.15% to end at 55,397, and Nifty 50, settled above the 16,500 mark. Ahead of today’s session, SGX Nifty hinted at a flat start for domestic benchmark indices as Nifty futures were trading 6 points, or 0.04%, higher at 16,503 on the Singapore Exchange. Globally, US stocks ended higher on Wednesday on positive earnings signals with a wary eye on inflation and more interest rate hikes by the Fed, while Asian markets were trading mixed in morning deals.

Indian indices opened flat with negative bias amid mixed global cues. The Sensex was down 102.97 points or 0.19% at 55,294.56, and the Nifty was down 31.90 points or 0.19% at 16,488.90.

Benchmark indices BSE Sensex, NSE Nifty 50 were trading marginally lower in pre-open session.

Nifty Put options OI distribution shows that 16,200 has highest OI concentration followed by 16,300 & 16,400 which may act as support for current expiry and on the Call front 16,600 followed by 16,700 & 16,800 witnessed significant OI concentration and may act as resistance for current expiry. Options data suggest an immediate trading range between 16,650 and 16,350 levels and 16,500 acting as pivotal levels

NSE Nifty 50 index opened gap up by more than 200 points and then remained consolidative within a range of 100 points throughout the day on Wednesday. The index failed to hold at higher levels and witnessed marginal profit booking to close the day with gains of 180 points. It formed a Bearish candle on the daily scale as it closed lower than its opening zones but has been forming higher lows from the last four sessions which indicates that the base of the market is shifting higher.

0 Comment