01 Oct , 2024 By : Debdeep Gupta

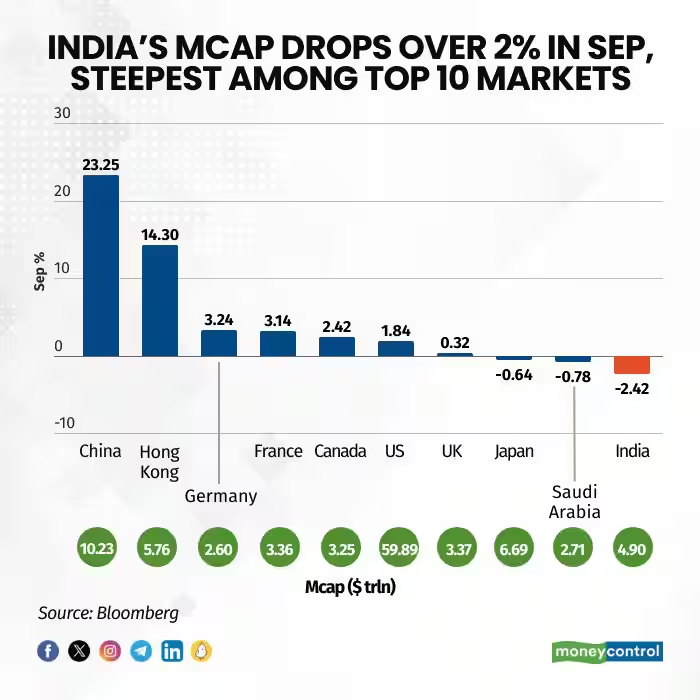

India's stock market, the world's fifth largest, posted the sharpest decline among the top 10 global markets in September, with market capitalization shrinking by 2 percent.

The country's total market value fell to $4.90 trillion from $5.03 trillion, the second straight monthly decline, despite benchmark indices, Sensex and Nifty, surging over 2.4 percent each. Broader indices also gained between 0.6 percent and 2 percent, but sector-wise losses dragged down the market.

The decline in September was primarily driven by weakness in information technology, oil & gas, energy, PSU, defense, and telecom stocks. The BSE Telecommunications index was the hardest hit, falling over 5 percent, followed by the BSE Oil & Gas and Energy indices, each losing 3 percent. Other sectors also saw losses, with the BSE IT Index, Services, and Teck down 2.6 percent, 1.7 percent, and 1.4 percent, respectively, while BSE Industrial and Capital Goods slipped 0.6 percent and 0.2 percent.

Deepak Jasani, Head of Retail Research at HDFC Securities, said the fall in market cap of Indian stocks during the month in dollar terms is due to a fall in values of smallcaps/midcaps including those of X group on BSE - stocks listed on BSE and appreciation of dollar vs the rupee.

Incidentally, the rupee gained just 0.08 percent against the dollar in September. The dollar index, which measures the US currency’s strength against major currencies, fell 0.9 percent in September to 100.78 from 101.7 a month ago.

Further, the movement in the indices has been driven more by funds over these months and their interest has been in large caps and select midcaps with the result that the rest of the market kept languishing.

As the IPO market continued to do well, investors may have chosen to book some profits in their holdings in small and midcaps (that had anyway risen quite well over the last few quarters) to use that money in applying for IPOs, Jasani added.

In contrast, China and Hong Kong led global gains, rising over 23 percent and 14 percent, followed by Germany and France, which each gained more than 3 percent. The US added 1.8 percent, Canada climbed 2.4 percent, Saudi Arabia and Japan fell 0.8 percent and 0.7 percent, while the UK posted modest gains of 0.3 percent.

Chinese stocks surged after Beijing introduced aggressive stimulus measures, including major rate cuts and fiscal support, to revive the struggling economy. The People's Bank of China (PBOC) also launched new tools to boost the capital market, easing access to funding for stock purchases.

This sparked a rally in beaten-down stocks, lifting the CSI300 by 21 percent in September, its best since 2014. The Shanghai Composite rose 17 percent, its highest since 2015, while the Hang Seng had its best month since November 2022 with a 17 percent gain.

Divam Sharma, smallcase Manager, CEO, and Co-Founder - Green Portfolio said other global markets are seeing a rally driven by the US. The US is seeing a run-up in the equity markets after the Fed cut overnight rates by 50 bps. This action by the Fed has turned the sentiment positive in other global markets too.

0 Comment