19 Jul , 2024 By : Debdeep Gupta

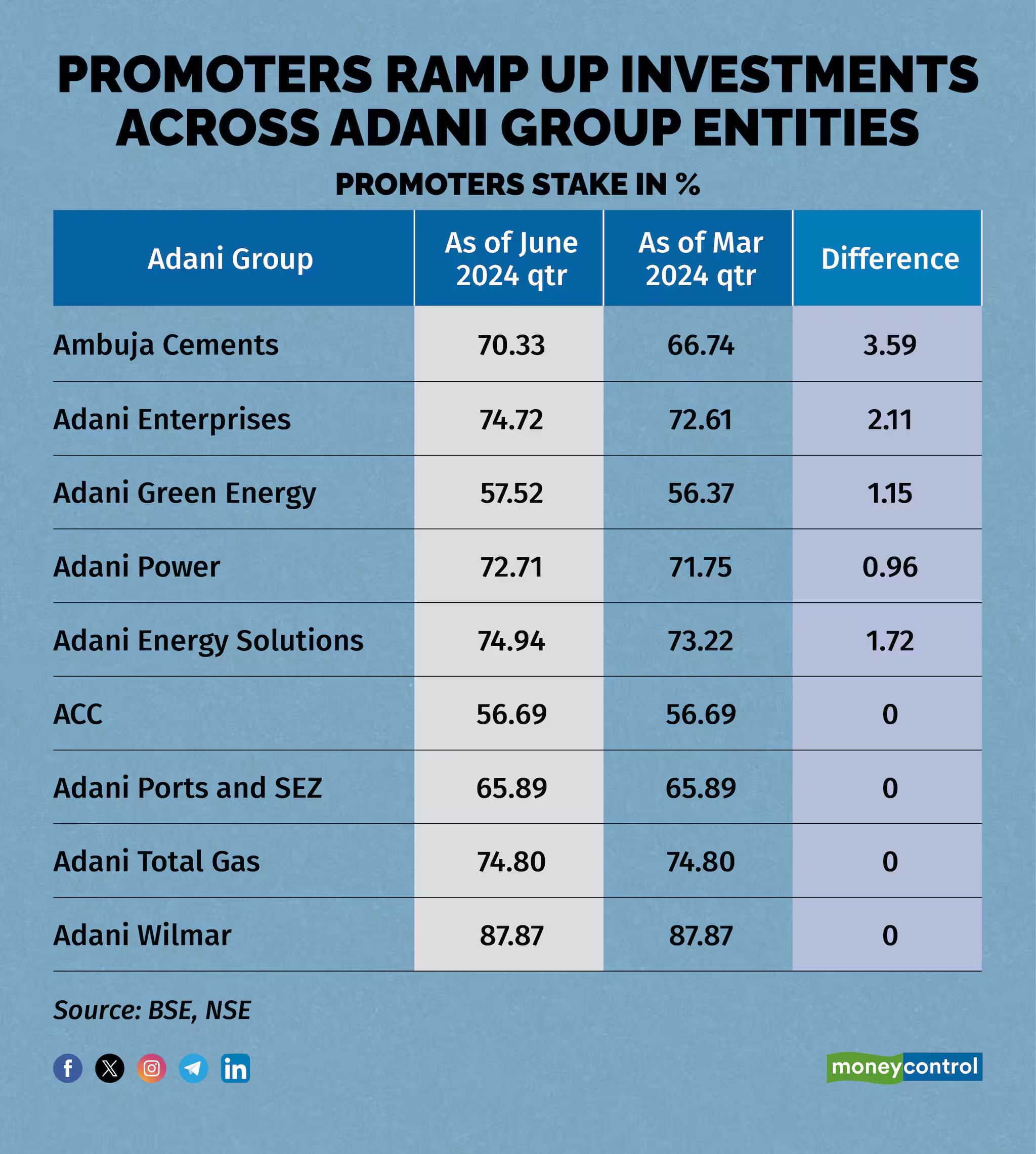

Promoters raised their holdings in five Adani Group firms -- Adani Energy Solutions Ltd, Adani Enterprises Ltd, Ambuja Cement Ltd, Adani Power Ltd, and Adani Green Energy Ltd – by pumping in a little over Rs 23,000 crore during the June quarter, the latest shareholding data shows.

Promoters raised their holdings in five Adani Group firms -- Adani Energy Solutions Ltd, Adani Enterprises Ltd, Ambuja Cement Ltd, Adani Power Ltd, and Adani Green Energy Ltd – by pumping in a little over Rs 23,000 crore during the June quarter, the latest shareholding data shows.

Promoter holding in Ambuja Cement has risen by 3.59 percentage points to 70.33 percent from 66.74 percent. In April, the company said that the Gautam Adani family had invested an additional Rs 8,339 crore towards capacity expansion. The Adani family had in October 2022 invested Rs 5,000 crore, and then Rs 6,661 crore in March this year.

Cumulatively, the multiple rounds of investment completed the planned Rs 20,000 crore capital infusion into Ambuja Cements.

In Adani Enterprises, the promoter holding rose by 2.11 percentage points to 74.72 percent during the quarter. Based on the average stock price of Rs 3,175 during the quarter, promoters would have shelled out roughly Rs 7,600 crore for the additional stake.

Promoter holding in Adani Green Energy increased by 1.15 percentage points to 57.52 percent. Based on the average stock price of Rs 1,788 during the quarter, the additional stake would have cost the promoters around Rs 3,200 crore.

Promoter holding in Adani Power rose 0.96 percentage points to 72.71 percent, and that in Adani Energy Solutions increased by 1.72 percentage points to 74.94 percent. Based on the average stock price for the quarter, the promoters would have spent around Rs 2,642 crore and Rs 1,917 crore respectively.

Meanwhile, the promoter stakes in ACC, Adani Ports and SEZ, Adani Total Gas, and Adani Wilmar remained unchanged from the previous quarter.

Ajay Bodke, an independent analyst, said promoters raising stakes in firms was a signal of their confidence in the long-term growth prospects of the businesses. It also reflected the promoters’ belief that the intrinsic value of the company was higher than what the market thought it was worth.

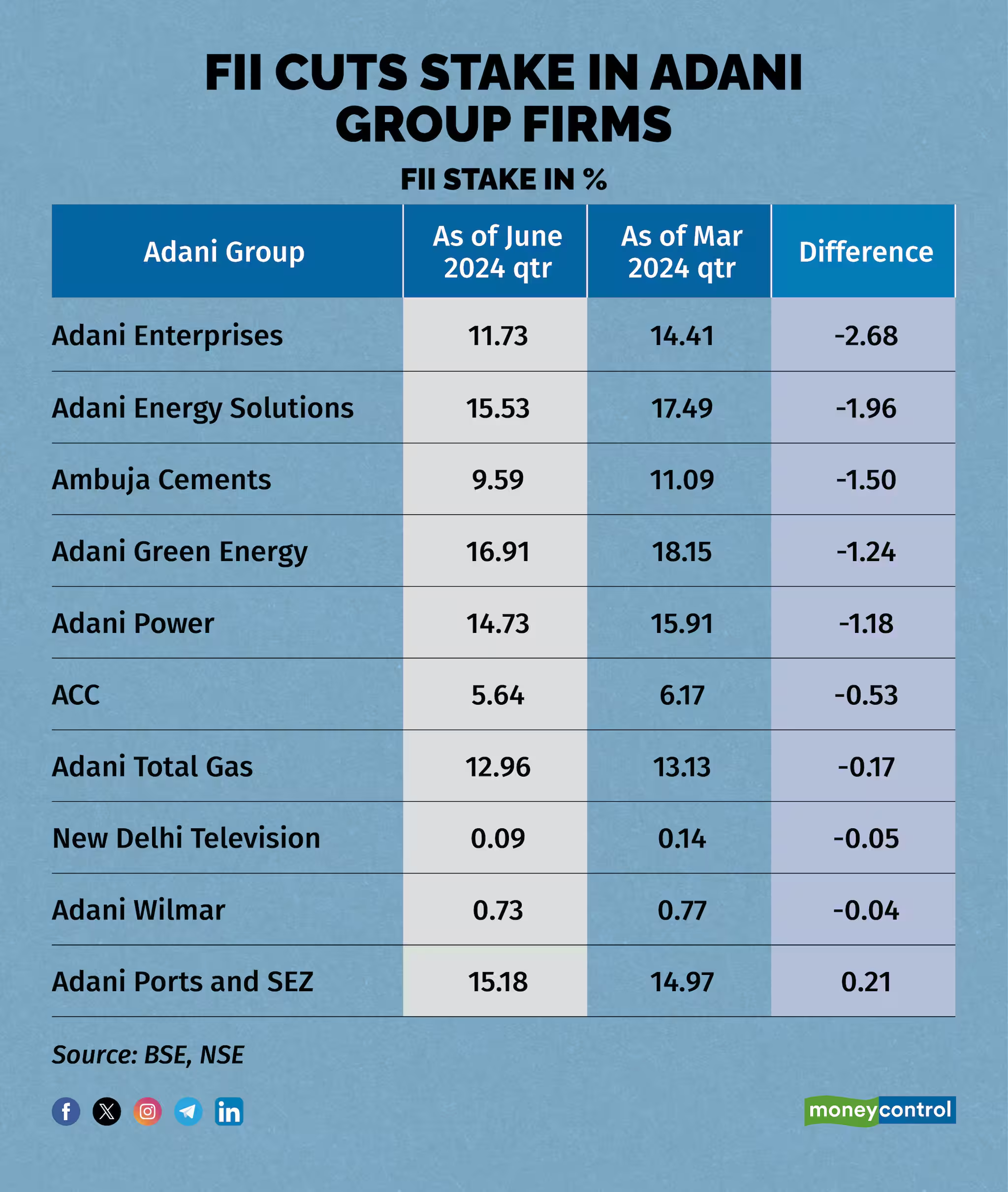

Meanwhile, foreign investors have significantly reduced their holdings across several Adani Group companies during the June quarter. Rajiv Jain's GQG Partners have retained their stakes in various Adani Group stocks, except for ACC and Adani Power Ltd. GQG sold around 34 lakh shares of Adani Power, valued at Rs 244 crore, and 35.73 lakh shares of ACC, valued at Rs 240 crore.

Adani Enterprises saw FII holdings decrease from 14.41 percent to 11.73 percent, while their exposure to Adani Energy Solutions stake dropped from 17.49 percent to 15.53 percent, and to Ambuja Cements fell from 11.09 percent to 9.59 percent. Similarly, Adani Green Energy's FII holdings declined from 18.15 percent to 16.91 percent, and ACC saw a reduction from 6.17 percent to 5.64 percent.

Adani Total Gas saw a slight decrease in FII stake, as did NDTV and Adani Wilmar. In contrast, FII's stake in Adani Ports and SEZ increased by 0.21 percentage points during the same period.

Last week, the Supreme Court rejected a plea for review of its January 3 decision not to transfer the probe into stock price manipulation allegations against the Adani Group to a special investigation team or the CBI. The court upheld its earlier ruling that SEBI's ongoing investigation into the allegations inspires confidence, despite claims of errors in the judgment and new material presented by the petitioner's counsel.

0 Comment