04 Oct , 2024 By : Debdeep Gupta

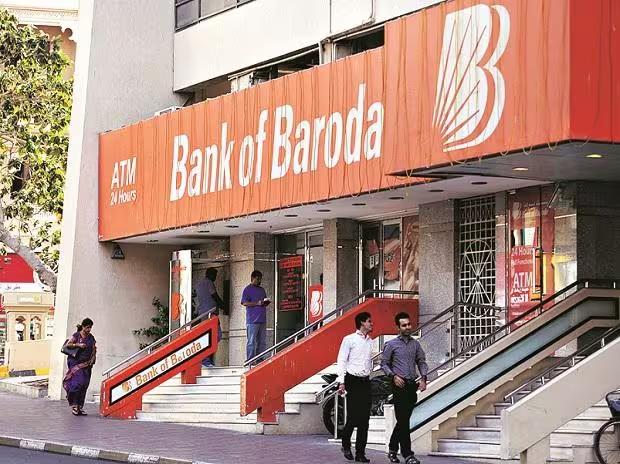

Shares of Bank of Baroda surged by 4 percent to Rs 255 per share on October 4, after the public sector lender released its business update for the second quarter of FY25. Alongside the update, the bank also announced its decision to divest its Oman operations to Bank Dhofar, as part of a strategy to streamline its international operations.

During the July-September quarter, Bank of Baroda posted a significant increase in its global advances, which grew by 11.6 percent year-on-year (YoY) to Rs 11.43 lakh crore. The domestic advances also rose by 12.51 percent to Rs 9.39 lakh crore. On the deposits front, global deposits registered a robust 9.11 percent YoY growth, reaching Rs 13.63 lakh crore, while domestic deposits grew 7.4 percent YoY to Rs 11.50 lakh crore.

The bank’s retail segment of domestic deposits also experienced notable growth, increasing by 19.9 percent to Rs 2.32 lakh crore, compared to Rs 1.93 lakh crore in the corresponding period last year. This growth in both advances and deposits underscores the bank’s strong position in the market and its ability to capture a larger share of the lending and deposit landscape.

Following this strong performance, Citi analysts reaffirmed their positive outlook on the stock, issuing a 'buy' recommendation with a target price of Rs 300 per share. This target suggests a potential upside of 17 percent from the current levels. According to Citi, the growth in global advances exceeded their estimates, while the sequential deposit growth was also solid, contributing to the positive sentiment.

Morgan Stanley also weighed in on the business update, maintaining an 'equal-weight' rating on the stock and setting a target price of Rs 265 per share. The firm highlighted the bank’s strong overseas loan book and healthy deposit growth as key factors behind its positive assessment.

In addition to its quarterly business performance, Bank of Baroda’s decision to offload its Oman operations is part of a broader effort to rationalize its foreign operations. The total business of Bank of Baroda in Oman amounts to OMR 113.35 million, with a net worth of OMR 25.54 million.

0 Comment