14 Jul , 2022 By : Monika Singh

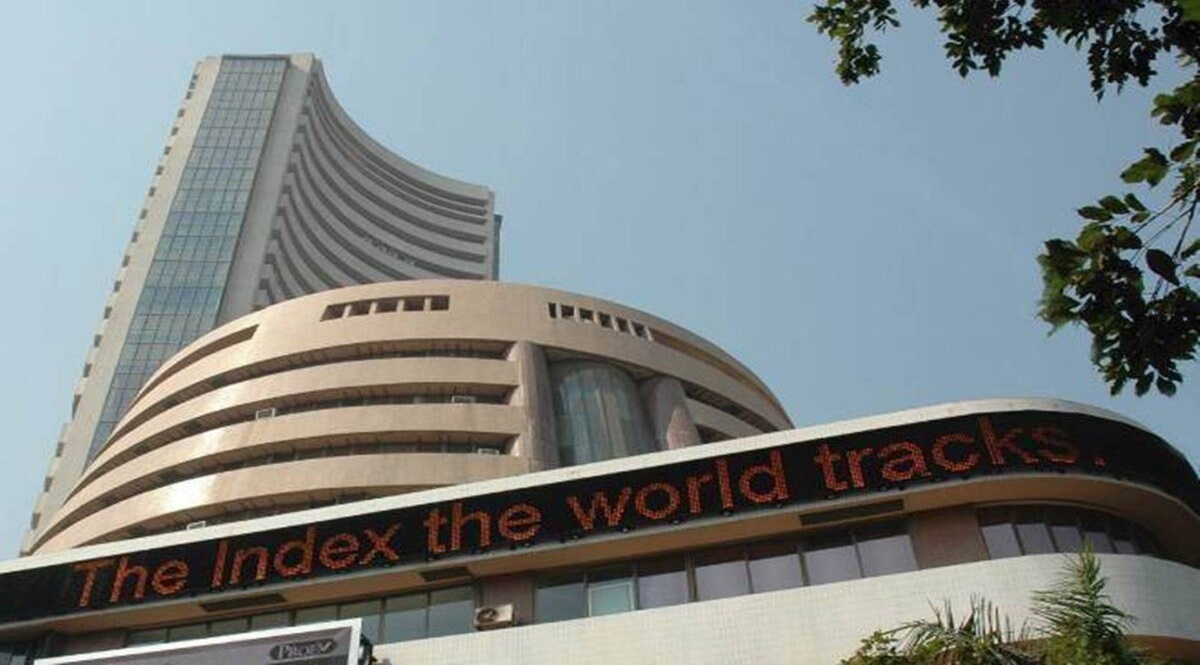

Share Market News Today | Sensex, Nifty, Share Prices LIVE: Domestic equity market benchmarks BSE Sensex and NSE Nifty 50 were trading flat to positive on Thursday, a day of weekly F&O expiry. S&P BSE Sensex rose more than 150 points or 0.33% to near 53,700 while the NSE Nifty 50 index breached 16,000 again. Bank Nifty was up with gains while India VIX was in the red. Broader markets sat in the green. Sun Pharma and Titan were the top gainers on Sensex, up close to 1.3?ch. Dr Reddy’s and Bharti Airtel followed. State Bank of India and Axis Bank were the top laggards, down nearly 0.5?ch. Nifty Bank index was trading in green at 34,864 levels

Sensex rose 150 points or 0.35% on the opening bell to close in on 53,700. Nifty 50 index regained 16,000

BSE Sensex jumped 163 points or 0.3 per cent to 53,667, while NSE Nifty 50 index reclaimed 16000 in pre-opening session on weekly F&O expiry day

Nifty Put options OI distribution shows that 15,800 has highest OI concentration followed by 15,600 & 15,700 which may act as support for current expiry and on the Call front 16,100 followed by 16,200 & 16,300 witnessed significant OI concentration and may act as resistance for current expiry. Options data suggest an immediate trading range between 15,800 and 16,200 levels

Share markets are volatile as of now, and going forward, a lot will depend on the fundamental factors such as inflation, interest rates globally, economic growth, currency moves and corporate performance in India, and technical factors like FPI fund flows and their risk appetite in investing in emerging countries like India. For the next 12 months, Nifty may make a top around 18,100 in the best case scenario, while on the downside it could fall towards 13,600. Triggers may keep emerging for Nifty to go in a particular direction,

0 Comment