17 Oct , 2022 By : Monika Singh

An almost-certain third term for Xi Jinping as China’s leader is fraught with more risks than rewards for India, as bilateral policies cutting across sectors — from foreign affairs to trade — will continue to have a security overhang.

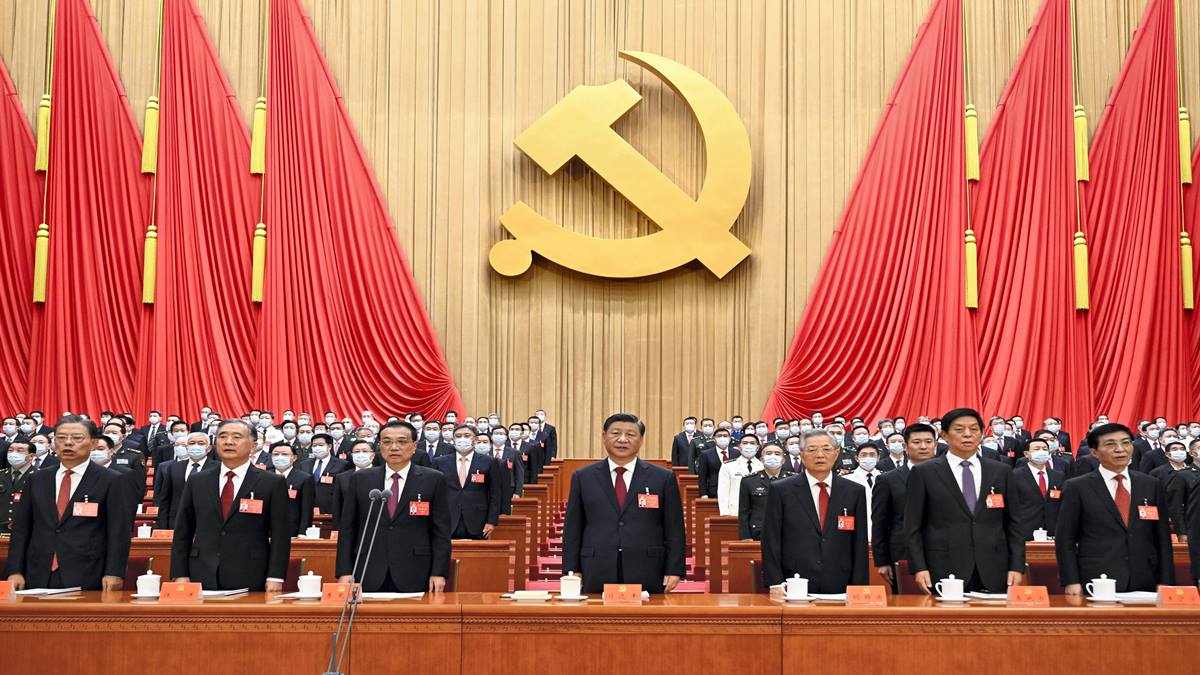

Xi, 69, is set to win the rare third term and further bolster his position as China’s most powerful ruler since Mao Zedong at the conclusion of the week-long congress that began on Sunday morning.

Experts told FE that Xi’s next term is unlikely to be very different from his second one. China under him will likely remain stubborn in not allowing greater market access to Indian merchandise as well as services without more attractive counter-offers from India, further tilting the already-massive trade imbalance in its favour.

During Xi’s term as Chinese President (he assumed the role in 2013), New Delhi’s goods trade deficit with Beijing has leaped to a record $73.3 billion in FY22 from $38.7 billion in FY13. China, in fact, accounted for about 38% of India’s overall trade deficit last fiscal. The deficit was as low as $0.7 billion in 2000-01 and has only exacerbated with China’s economic prowess.

In the absence of any free trade agreement between the two countries, tariff concessions for Indian exporters — especially in sectors of their interests, such as agriculture, textiles & garments, pharmaceuticals and leather — will remain a dream. The infamous non-tariff barriers, often erected by China to mask its fierce trade protectionism towards rivals, may continue to grow. This means even Indian IT and ITeS firms, which are globally competitive, will continue to struggle to capture a bigger slice of the Chinese market.

The muscle-flexing by China under Xi will continue, as its economic clout grows, further jeopardising security interests of India and others in the Indo-Pacific region. This may lead to more partnerships among like-minded nations along the lines of QUAD or the Indo-Pacific Economic Framework or the supply-chain initiative — mostly dominated by the US or its allies — to counter the Chinese threats.

C Uday Bhaskar, director at Society for Policy Studies, said: “In all likelihood, in his third term, Xi will pursue a hard-line policy with India as regards the line of actual control, and issues like the Galwan and Ladakh.”

The outcome of the war in Ukraine in relation to Russia’s profile and how the US-China bilateral tension unfolds, will also have implications for the India-China bilateral relations, he added.

At the regional level, Bhaskar said, the Chinese footprint is likely to be more visible, especially in Sri Lanka, Bangladesh and Nepal. “… managing this, will be a challenge for New Delhi, given that it does not have the economic/ trade vibrancy associated with Beijing,” he said.

For its part, New Delhi, too, will continue to follow a cautious and restrictive foreign direct investment policy for China. Such a policy was first adopted in the aftermath of the pandemic in April 2020, when India scrapped the automatic approval process and subjected FDI proposals from countries with which it shares land borders to government clearance. Even if it relaxes the norms in future, it will continue to remain wary of greater Chinese control in Indian companies in strategic sectors.

As such, FDI from China barely flowed in over the years. Between April 2000 and June 2022, FDI inflows from China stood at just $2.46 billion, or only 0.4% of total such inflows into India during this period.

Past pledges by China, including those under Xi, to ramp up investments in India in lieu of growing trade imbalance haven’t materialised. Of course, in recent years, Chinese investments in Indian startups have grown, although they still trail the immense potential. According to foreign policy think-tank Gateway House, Chinese investments in Indian startups between 2015 and 2020 touched $4 billion and 18 Indian unicorns were Chinese-funded. These included Byju’s, Paytm, Zomato, Big Basket, Ola and Swiggy.

Jayant Dasgupta, former ambassador of India to the World Trade Organization, said: “China’s growing economic strength isn’t much of a worry for many countries. But China, under Xi, wants to flex its muscle because of its economic strength, and as a consequence, it wants to make other countries defer to it. This has very dangerous implications.”

India relies on China for buying capital goods, raw materials and intermediate products. So, it’s not going to be an easy relationship to manage for New Delhi. While bilateral trade may increase (with greater economic growth) and India’s dependence on China won’t go away soon, many countries are trying to develop alternative supply source (China 1 policy). If and when it happens, this will blunt the supply-chain leverage that China currently enjoys, DasGupta said.

0 Comment