31 Aug , 2021 By : Nayan Singhal

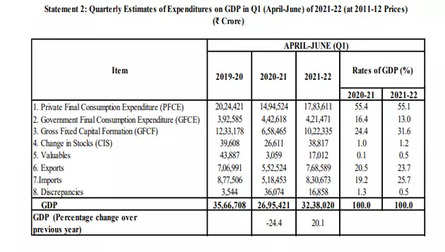

India’s Gross Domestic Product (GDP) for the April-June quarter (Q1) of the ongoing financial year 2021-22 (FY22) expanded 20.1% YoY, as per data released on Tuesday. The sharp rise in Q1 GDP data can be attributed to a low base last year. In the April-June quarter of 2020, the economy contracted 24.4% due to the Covid-19 lockdowns. The economy grew by 1.6% for Q4 of FY21 after showing contraction for the first two quarters and turning slightly positive in Q3.

“The consumer confidence survey conducted by the RBI serves as a useful proxy for demand from the less formal sectors. Its July 2021 round indicated that the Current Situation Index barely rose to 48.6 from a record low of 48.5 in the May 2021 round, highlighting the continued impact of the loss of income and employment, as well as higher medical expenses experienced by many households as a result of the second wave of Covid-19,” Icra chief economist Aditi Nayar said.

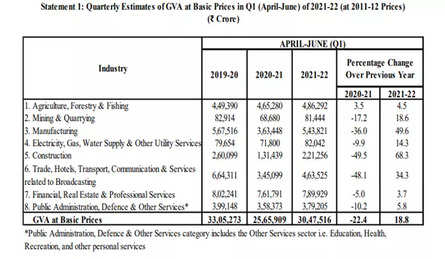

Icra has forecast the year-on-year (YoY) gross value added (GVA) at 17 per cent in Q1FY22, benefitting from healthy Central and state government capital spending, robust merchandise exports and resilient demand from the farm sector.

Regardless, the muted base of last year’s nationwide lockdown has aided in concealing the impact of the second wave of Covid-19.

Nayar said, “Based on our assessment of volumes and available earnings, we have forecast the GVA expansion in industry at a considerable 37.5 per cent in Q1FY22, led by construction and manufacturing, which experienced significantly less curbs in the just-concluded quarter compared to the situation during last year’s stringent nationwide lockdown. In particular, construction activity benefitted from the healthy Central and the state government capex spending in Q1FY22, which exceeded even the pre-Covid levels of Q1FY20.”

2 Comment

Queen_Of_Futures12021-08-31

one can only dance and drink and party tonight... India is in right hands, market zooom zoom zommer

Like(3) Dislike(0)Raj Misrhra892021-08-31

Modi Ji rocks..... We finally have a great leader

Like(0) Dislike(0)