29 Jul , 2022 By : Monika Singh

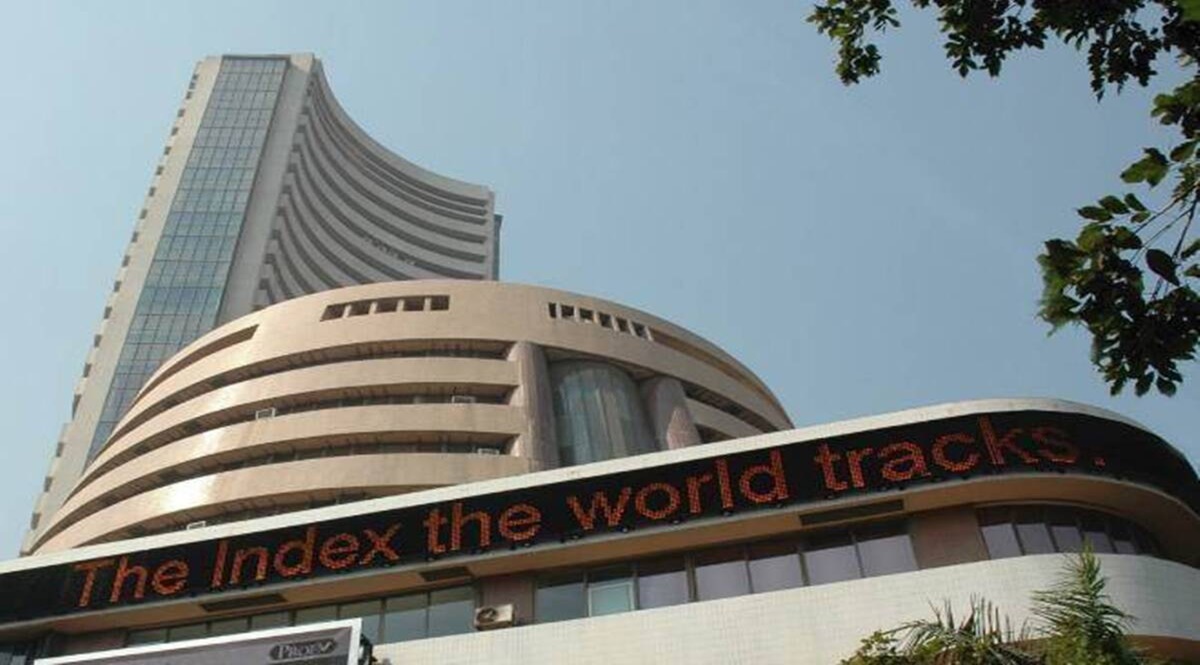

Share Market News Today | Sensex, Nifty, Share Prices LIVE: Bulls continued to dominate Dalal Street on Friday morning amid positive global cues. S&P BSE Sensex rose more than 500 points or 0.92% to breach 57,300 mark while the NSE Nifty 50 index was above 17,000 and closing in on 17,100. Bank Nifty touched 37,700 while India VIX slipped below 17 levels. Bajaj Finserv was the top gainer on Sensex, up 3%, followed by Tata Steel and Asian Paints. Dr Reddy’s was down 3.78?companied by Sun Pharma while all other stocks gained.

The 17500 objective discussed yesterday, appears to be in quick progression. Bullish exhaustion may set in on the first test of 17245, but a trend reversal is unlikely as long as the 16800/750 region holds. That being the broad levels, opening burst is likely to have continuity as long as 17080-16960 region holds downsides,”

“On the technical front, 16800 and 17200 are immediate support and resistance in Nifty 50. For Bank Nifty 37000 and 38000 are immediate support and resistance respectively,”

Sensex rallied 500 points on opening bell, regaining 57,300 while NSE Nifty 50 closed in on 17,100; Tata Steel was the top gainer on Sensex.

“In India the big positive for the market is the FIIs reducing their selling substantially and even turning buyers for 8 days this month. The expected outperformance of financials has played out well. Q1 results indicate improving prospects for this segment. The short covering bounce in IT may continue in the near-term. If the ongoing market rally continues for some more time there is the danger of the market moving into overbought territory with the risk of vulnerability to correction,”

“Nifty has formed a third back-to-back up-gap since July 15. None of the earlier two up-gaps have been filled so far suggesting the strength of the upward thrust. The large move up suggests that FPIs have now again started to come back into India in a big way as the uncertainty over rate hikes is behind us for the time being. 17092-17132 band is the next resistance for the Nifty while 16752 remains support for the near term,

0 Comment