13 Jun , 2024 By : Debdeep Gupta

Indian benchmark indices traded positively in Wednesday’s session, with Nifty registering a new record high of 23,441. However, it gave up most of the intraday gains towards the end and closed around 23,300 with marginal gains over the previous session’s close. Nifty continued its positive momentum, marking a new high over the 23,400 mark, while broader markets also kept the upward move intact as buying interest was seen in stocks. According to experts, the immediate supports for Nifty are placed around 23,150 and 22,950, with positional support around the 40 DEMA at 22,800. The stock-specific action remains robust, so traders are advised to focus on stock-specific moves with a buy-on-dip approach for the index. Here are 15 data points to help you spot profitable trades:

Key Levels for the Nifty 50:

Supports based on pivot points: 23,184.52, 23,104.18, and 22,921.38

Resistance based on pivot points: 23,367.32, 23,469.78, and 23,652.58

Special Formation: Nifty has formed a doji candle on the daily timeframe, with the daily RSI remaining neutral at 59.

Key Levels for the Bank Nifty:

Resistance based on pivot points: 50,137.45, 50,471.7, and 51,334.45

Support based on pivot points: 49,274.7, 48,746.2, and 47,883.45

Special Formation: Bank Nifty continued to trade within a sideways range with a positive bias, settling at 49,895.10, up 0.38%. It sustains above the short-term moving average. Over the past three sessions, Bank Nifty has formed doji candles on the daily timeframe. According to experts, the trend will become clearer if it moves above 50,300 or below 48,900. If these levels are not breached, the index might consolidate within this range for the next session.

Nifty Call Options Data: According to weekly options data, the 23,500 strikes (with 1.50 crore combined OI) had the maximum call open interest, acting as a key resistance level for Nifty in the short term. This was followed by the 23,800 strike (92 lakh combined OI). Strong call writing was observed at the 23,400 strike in Nifty.

Nifty Put Options Data: On the put side, the maximum open interest was at the 23,000 strikes (with 73 lahks combined OI), acting as a key support level for Nifty. This was followed by the 23,200 strike with 30 lakh combined OI.

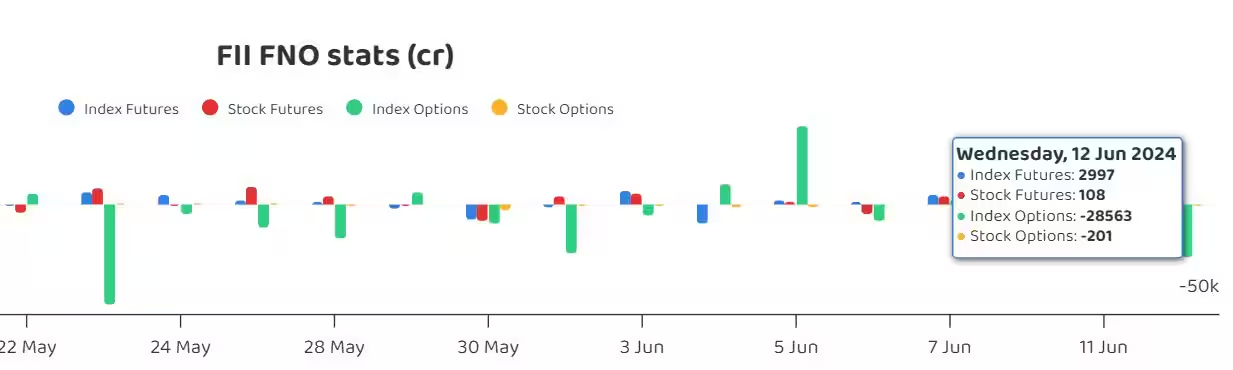

FII Funds Flow (Rs crore):

Put-Call Ratio: The Nifty Put-Call Ratio (PCR), indicating market sentiment, has improved moderately to 1.02. An increasing PCR above 0.7 or surpassing 1 generally indicates bullish sentiment, while a ratio below 0.7 or moving towards 0.5 indicates a bearish mood.

Nifty Max Pain Point: The Nifty max pain point has moved to the 23,200-23,150 strike price. The max pain theory shows the level at which option sellers will likely have the least expiry loss.

India VIX: Volatility remains in the 12-14 range. Compared to the previous session, India VIX, the fear index, closed at 14.39 percent, down 2 percent.

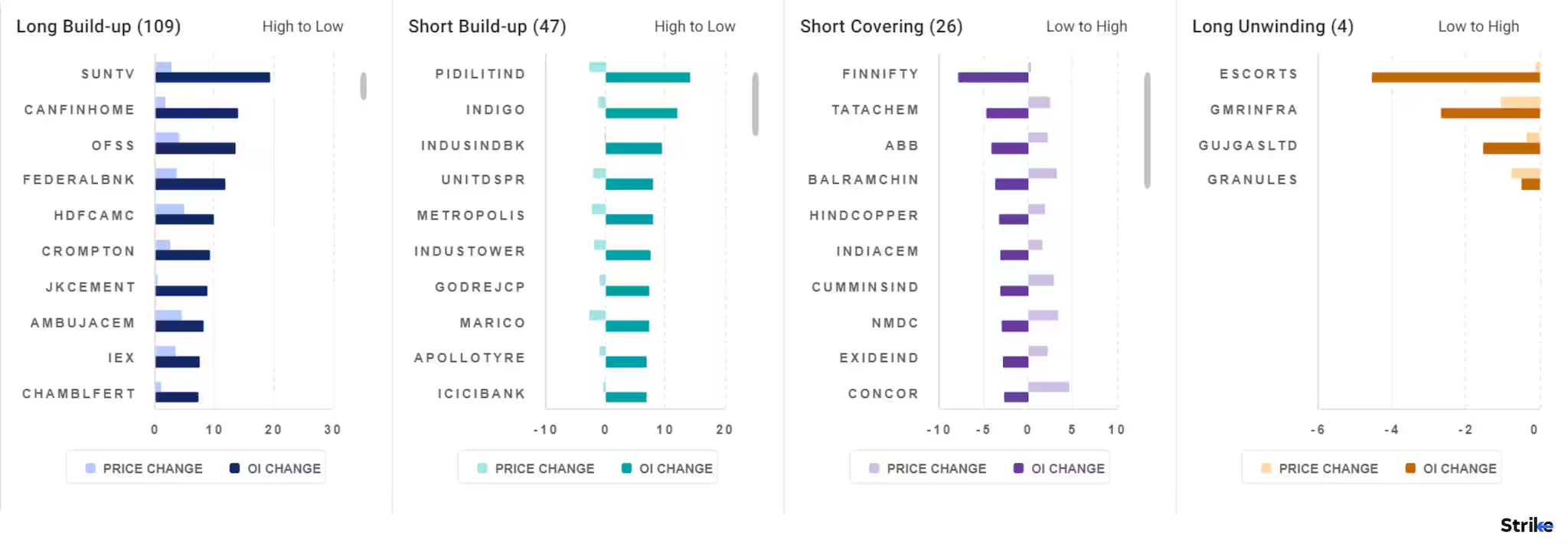

Long Build-up (109 Stocks): A long build-up was seen in 109 stocks, indicated by an increase in open interest (OI) and price.

Long Unwinding (4 Stocks): 4 stocks saw a decline in open interest (OI) and a fall in price, indicating long unwinding.

Short Build-up (26 Stocks): 26 stocks saw an increase in OI and a fall in price, indicating a build-up of short positions.Short-Covering (47 Stocks): 47 stocks saw short-covering, indicated by a decrease in OI along with a price increase.

0 Comment