01 Aug , 2021 By : Kanchan Joshi

Mutual fund calculator: If an investor wants to become rich, it needs not to invest in different options but to invest differently. As per the tax and investment experts, mutual funds SIP (systematic investment plan) is suitable for those investors who don't have a lump sum amount for investing but they want to create a whopping amount in long-term. Experts were of the opinion that while investing through monthly SIP, a mutual fund investor needs to increase one's investment in sync with growth in its annual income. This will enable them maximise the compounding benefit in long-term.

Speaking on the mutual funds SIP to get higher maturity amount in comparison to other mutual fund investors Kartik Jhaveri, Director — Wealth Management at Transcend Consultants said, "Mutual fund SIP is suitable for those earning individuals who are in the nascent phase of their career and they don't have a lump sum amount for investing. Such investors can choose the monthly SIP using annual step-up trick. As one needs to increase one's investment in sync with increase of one's income, it's advisable to use annual step-up trick while investing in mutual fund SIP in monthly mode."

On how much step up will be enough for an earning individual if it want to accumulate Rs10 crore in 25 years; SEBI registered tax and investment expert Jitendra Solanki said, "Generally, a mutual fund SIP investor uses 10 per cent annual step up but they invest for 30 years or till they retire. Here, the individual want to accumulate Rs10 crore in 25 years only, in that case he or she is advised to use 15 per cent annual step-up." He also said that the investor will have to invest in equity mutual fund as the investor needs to take some risk for creating Rs10 crore corpus in 25 years.

On how much annual return on can expect from mutual fund SIP, both experts agreed that one can expect at least 12 per cent return from the mutual fund SIP if the investment period is 25 years.

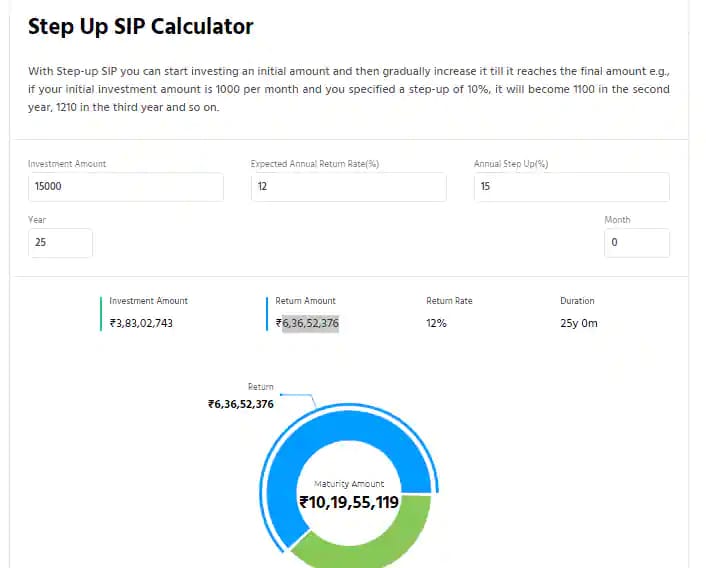

So, if an earning individual invests in monthly SIP for 25 years using 15 per cent annual step-up, then assuming 12 per cent annual return, the mutual fund calculator suggests that one will have to start with Rs15,000 monthly SIP.

The mutual fund calculator further says that in this 25 years of investment, the investor would be investing Rs3,83,02,743 while the interest earned during this entire period would be Rs6,36,52,376.

0 Comment