12 Nov , 2024 By : Debdeep Gupta

Nifty Trade Setup

The Nifty 50 had a volatile session on November 11, trading within a 200-point range and closing flat with a negative bias. The index climbed above the 10-day EMA (Exponential Moving Average) at 24,270 but failed to hold on to these gains due to selling pressure at higher levels. Hence, 24,300 is likely to act as immediate resistance for the index, followed by 24,500, which is a crucial hurdle, experts said. The index managed to respect 24,000, which is expected to act as support, with 23,800 seen as the next key support level. Therefore, the overall range remains between 23,800 and 24,500.

Here are 15 data points we have collated to help you spot profitable trades:

1) Key Levels For The Nifty 50 (24,141.30)

Resistance based on pivot points: 24,288, 24,366, and 24,493

Support based on pivot points: 24,034, 23,956, and 23,829

Special Formation: The Nifty formed a small green candle with a long upper shadow on the daily timeframe, indicating selling pressure at higher levels. The index continued to form lower lows for the third consecutive session, with average volumes, which is a negative sign. On the monthly scale, a High Wave pattern was observed, indicating indecision among bulls and bears regarding the future market trend.

2) Key Levels For The Bank Nifty

Resistance based on pivot points: 52,120, 52,329, and 52,666

Support based on pivot points: 51,445, 51,237, and 50,899

Resistance based on Fibonacci retracement: 52,325, 52,831

Support based on Fibonacci retracement: 51,271, 50,263

Special Formation: The Bank Nifty formed a sizeable bullish candle with both upper and lower shadows on the daily charts, rising 316 points to 51,877 amid volatility. The index climbed above all key short-term moving averages but continued its lower lows formation for the third straight day. Overall, the index has been trading within the range of the previous month.

3) Nifty Call Options Data

According to the weekly options data, the 25,000 strike holds the maximum open interest (with 79.8 lakh contracts). This level can act as a key resistance level for the Nifty in the short term. It was followed by the 24,500 strike (71.59 lakh contracts), and the 24,800 strike (50.86 lakh contracts).

Maximum Call writing was observed at the 24,700 strike, which saw an addition of 16.24 lakh contracts, followed by the 24,300 and 24,500 strikes, which added 14.52 lakh and 11.74 lakh contracts, respectively. The maximum Call unwinding was seen at the 25,000 strike, which shed 4.83 lakh contracts, followed by the 24,100 and 24,000 strikes which shed 1.27 lakh, and 62,825 contracts, respectively.

4) Nifty Put Options Data

On the Put side, the maximum open interest was seen at the 23,000 strike (with 60.94 lakh contracts), which can act as a key support level for the Nifty. It was followed by the 23,500 strike (44.07 lakh contracts), and the 24,000 strike (38.88 lakh contracts).

The maximum Put writing was placed at the 23,600 strike, which saw an addition of 12.55 lakh contracts, followed by the 23,700, and 24,000 strikes, with 12.48 lakh, and 9.82 lakh contracts added, respectively, while the maximum Put unwinding was seen at the 24,500 strike, which shed 79,625 contracts, followed by the 23,200 and 24,800 strikes which shed 64,375 and 43,175 contracts, respectively.

5) Bank Nifty Call Options Data

According to the weekly options data, the 53,000 strike holds the maximum open interest, with 43.75 lakh contracts. This can act as a key resistance level for the index in the short term. It was followed by the 52,500 strike (27.56 lakh contracts) and the 52,000 strike (21.21 lakh contracts).

Maximum Call writing was visible at the 53,000 strike (with the addition of 15.71 lakh contracts), followed by the 52,200 strike (5.55 lakh contracts) and the 51,900 strike (2.41 lakh contracts), while the maximum Call unwinding was seen at the 52,500 strike, which shed 6.92 lakh contracts, followed by the 51,700 and 51,800 strikes, which shed 2.33 lakh and 2.17 lakh contracts, respectively.

6) Bank Nifty Put Options Data

On the Put side, the maximum open interest was seen at the 51,000 strikes (with 18.7 lakh contracts), which can act as a key support level for the index. This was followed by the 51,500 strike (16.95 lakh contracts) and the 51,600 strike (15.15 lakh contracts).

The maximum Put writing was observed at the 51,600 strike (which added 8.84 lakh contracts), followed by the 51,400 strikes (8.24 lakh contracts) and the 51,300 strike (7.92 lakh contracts), while the maximum Put unwinding was seen at the 50,800 strike, which shed 4.59 lakh contracts, followed by the 52,300 and 52,500 strikes, which shed 22,170 and 960 contracts, respectively.

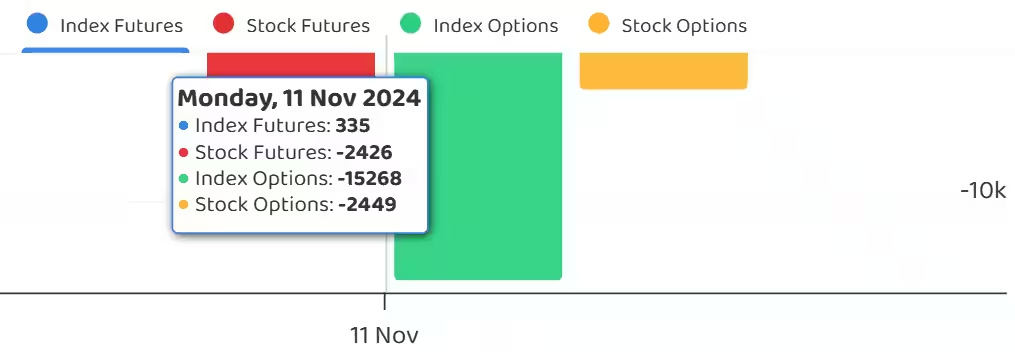

7) Funds Flow (Rs crore)

8) Put-Call Ratio

The Nifty Put-Call ratio (PCR), which indicates the mood of the market, remained flat at 0.91 on November 11, compared to the previous session.

The increasing PCR, or being higher than 0.7 or surpassing 1, means traders are selling more Put options than Call options, which generally indicates the firming up of a bullish sentiment in the market. If the ratio falls below 0.7 or moves towards 0.5, then it indicates selling in Calls is higher than selling in Puts, reflecting a bearish mood in the market.

9) India VIX

Volatility declined for another session and remained below the 15 mark on a closing basis for the fourth consecutive session. The India VIX closed at 14.27, down 1.38 percent from the previous level of 14.47. If it falls and sustains below the 14 mark, bulls may find themselves in a more comfortable zone.

10) Long Build-up (26 Stocks)

A long build-up was seen in 26 stocks. An increase in open interest (OI) and price indicates a build-up of long positions.

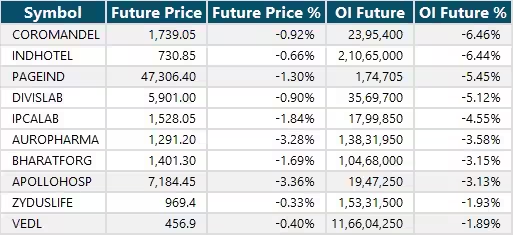

11) Long Unwinding (50 Stocks)

50 stocks saw a decline in open interest (OI) along with a fall in price, indicating long unwinding.

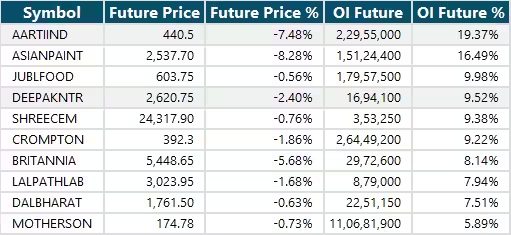

12) Short Build-up (75 Stocks)

75 stocks saw an increase in OI along with a fall in price, indicating a build-up of short positions.

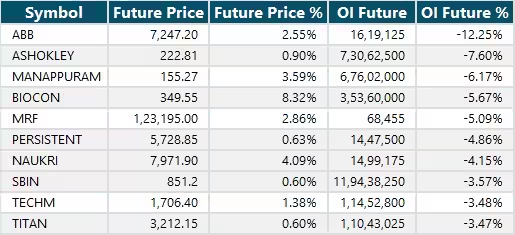

13) Short-Covering (30 Stocks)

30 stocks saw short-covering, meaning a decrease in OI, along with a price increase.

14) High Delivery Trades

Here are the stocks that saw a high share of delivery trades. A high share of delivery reflects investing (as opposed to trading) interest in a stock.

15) Stocks Under F&O Ban

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Stocks added to F&O ban: Aarti Industries, Hindustan Copper

Stocks retained in F&O ban: Aditya Birla Fashion & Retail, Granules India, Manappuram Finance

Stocks removed from F&O ban: Nil

0 Comment