08 Jul , 2024 By : Debdeep Gupta

The record highs on Dalal Street seem to be backed by earnings growth as well, tempering concerns that stocks may have run ahead of fundamentals.

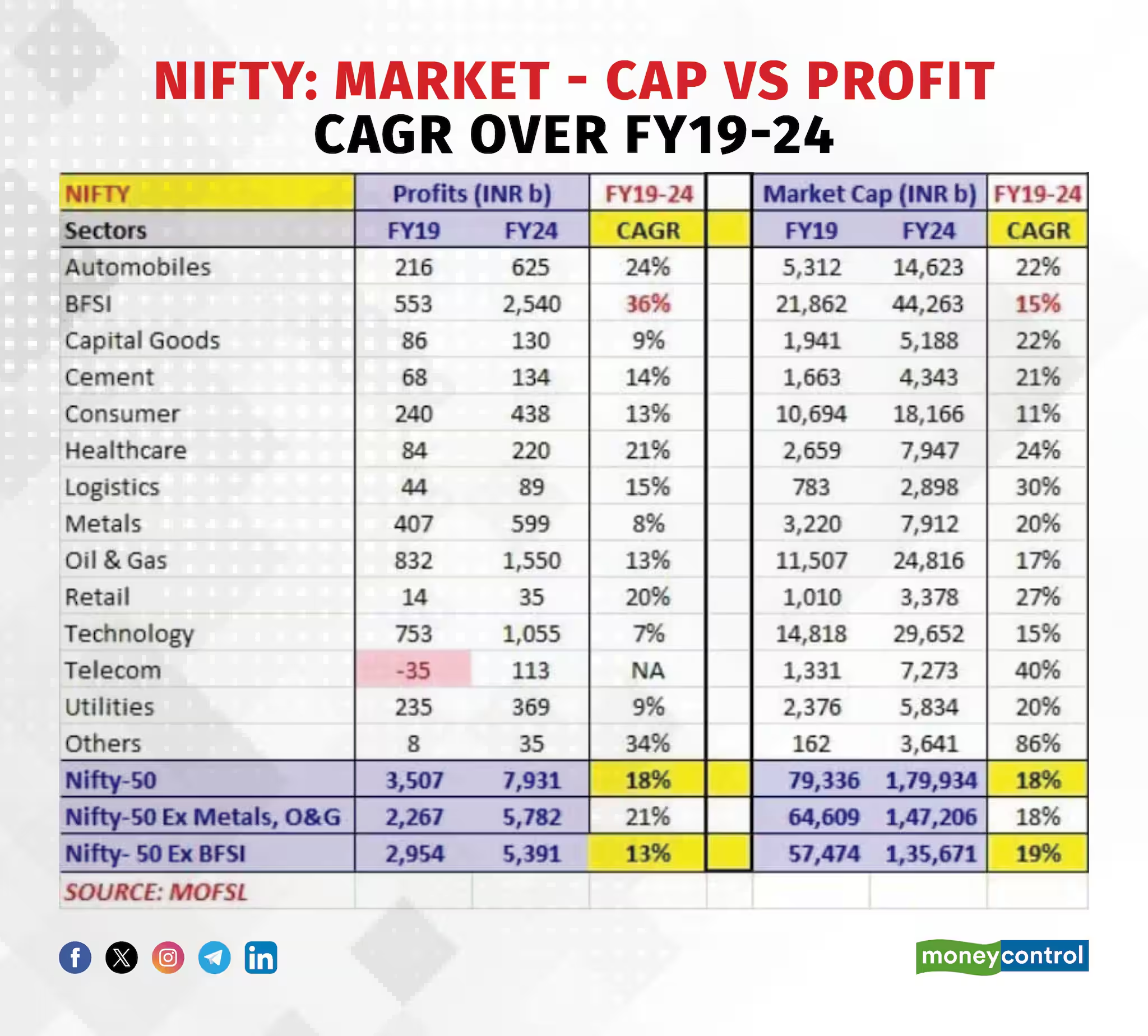

A report by Motilal Oswal Financial has said that over the last five years, the Nifty 50 benchmark’s market capitalization and underlying profits both have achieved an 18?GR. A section of analysts agree with this view that Indian markets have grown in line with earnings, and record levels seem less alarming. This is significant, as some experts have been voicing concerns that the rally may have taken the market ahead of fundamentals.

Souvik Saha, Investment Strategist at DSP Mutual Fund, while countering claims that the Nifty is over-valued, points out that the Nifty's total earnings growth and market cap have both achieved an 18?GR over the past five years.

This indicates that the Nifty 50 index is tracking its earnings, and criticism of being overvalued is unfounded. Further, Souvik Saha added that comparing the current valuations to historical ones may be misleading.

Stable earnings imply the market is on solid ground, and indications of the Nifty being overpriced or unsafe are incorrect, he added.

Analysts also suggest that a notable aspect this time is the impact of external economic factors like global inflation, US interest rates, and geopolitical events on certain sectors.

For instance, the banking, financial services & insurance (BFSI) segment has been a significant driver, with profit surging by 36 percent CAGR and market capitalization rising by 15 percent.

While BFSI has shown strong profits and improved NPAs, growth in market capitalization has largely remained modest. This, analysts say, is likely due to domestic investors being equal or underweight on banks and the absence of fresh foreign investment.

Major selling by foreign investors in the banking sector over the past 18 months has impacted market capitalization, however, foreign investors are now returning, suggesting a potential rally as foreign ownership rises.

The sector's fundamentals are strong, with high credit growth, good credit quality, and world-class books and corporate loan growth is also expected to pick up, indicating that the BFSI sector should not underperform going forward, analysts told a Source.

Among other sectors, telecom, despite past losses, saw a remarkable 40 percent market capitalization growth. Analysts attribute this turnaround to industry consolidation, regulatory relief, and higher demand for data services amid digital transformation.

The healthcare sector's profit growth (21 percent CAGR) and market cap (24 percent CAGR) likely reflect increased healthcare spending, medical advancements, and rising demand for services. In contrast, the technology sector's modest growth suggests competitive pressures, and market saturation affecting profitability.

Automobiles saw a 24 percent CAGR in profits and a 22 percent increase in market cap while capital goods posted a modest nine percent profit CAGR, but its market cap grew by 22 percent, indicating strong investor confidence in future growth.

The cement sector mirrored this trend with a 14 percent profit CAGR and a 21 percent rise in market cap. The consumer sector, while showing a 13 percent profit CAGR, had a slightly lower market cap growth at 11 percent.

0 Comment