29 Jan , 2025 By : Debdeep Gupta

The benchmark Nifty 50 and Bank Nifty rebounded smartly but faced some selling pressure at higher levels on January 28 amid higher volatility and caution ahead of the Budget. The Doji formation on the Nifty indicated indecision between the bulls and bears. The index could not sustain above the 23,000 mark on a closing basis, which is crucial for further upside toward 23,150 and then 23,350. However, if it stays below 23,000, consolidation may be seen with support in the 22,800–22,750 zone. The broader trading range could be 22,500–23,500. The Bank Nifty may extend its journey toward 49,300 again as long as it defends the 48,450 zone. In the case of a correction, 48,300 can act as support, followed by 48,050, according to experts.

On Tuesday, January 28, the Nifty 50 rallied by 128 points (0.56 percent) to 22,957, while the Bank Nifty jumped by 802 points (1.67 percent) to 48,867, despite weak market breadth. A total of 1,812 shares declined against 767 shares that advanced on the NSE.

Nifty Outlook and Strategy

Dhupesh Dhameja, Derivative Research Analyst at Samco Securities

The Nifty index paused its recent corrective phase, buoyed by the Reserve Bank of India's liquidity injection plan, inching closer to the critical psychological barrier of 23,000. On the hourly chart, a bullish divergence signals potential upward momentum, while the index has established a sturdy support base between 22,700 and 22,800. However, the index remains capped below its 10-day EMA, which acts as a significant hurdle at 23,100. Intraday gains were swiftly eroded by profit-booking, indicating persistent selling pressure.

Currently, the index is navigating the crucial 23,050–23,100 range, a resistance zone strengthened by heavy Call writing activity. On the daily chart, an indecision candlestick pattern has emerged, underscoring market hesitation. Follow-through buying is essential to confirm a reversal.

Options market data further supports this narrative, with substantial Put additions at lower strikes (22,700–23,000) fortifying the support zone. Conversely, immediate resistance at 23,100–23,330 remains a formidable obstacle. Nifty’s price action suggests a potential rebound, supported by bullish divergence on hourly charts. Should the index successfully breach the 23,100 level, it could pave the way for a robust recovery, targeting 23,500 and renewing hopes for continued upside momentum.

Key Resistance: 23,000, 23,300, 23,500

Key Support: 22,850, 22,700, 22,500.

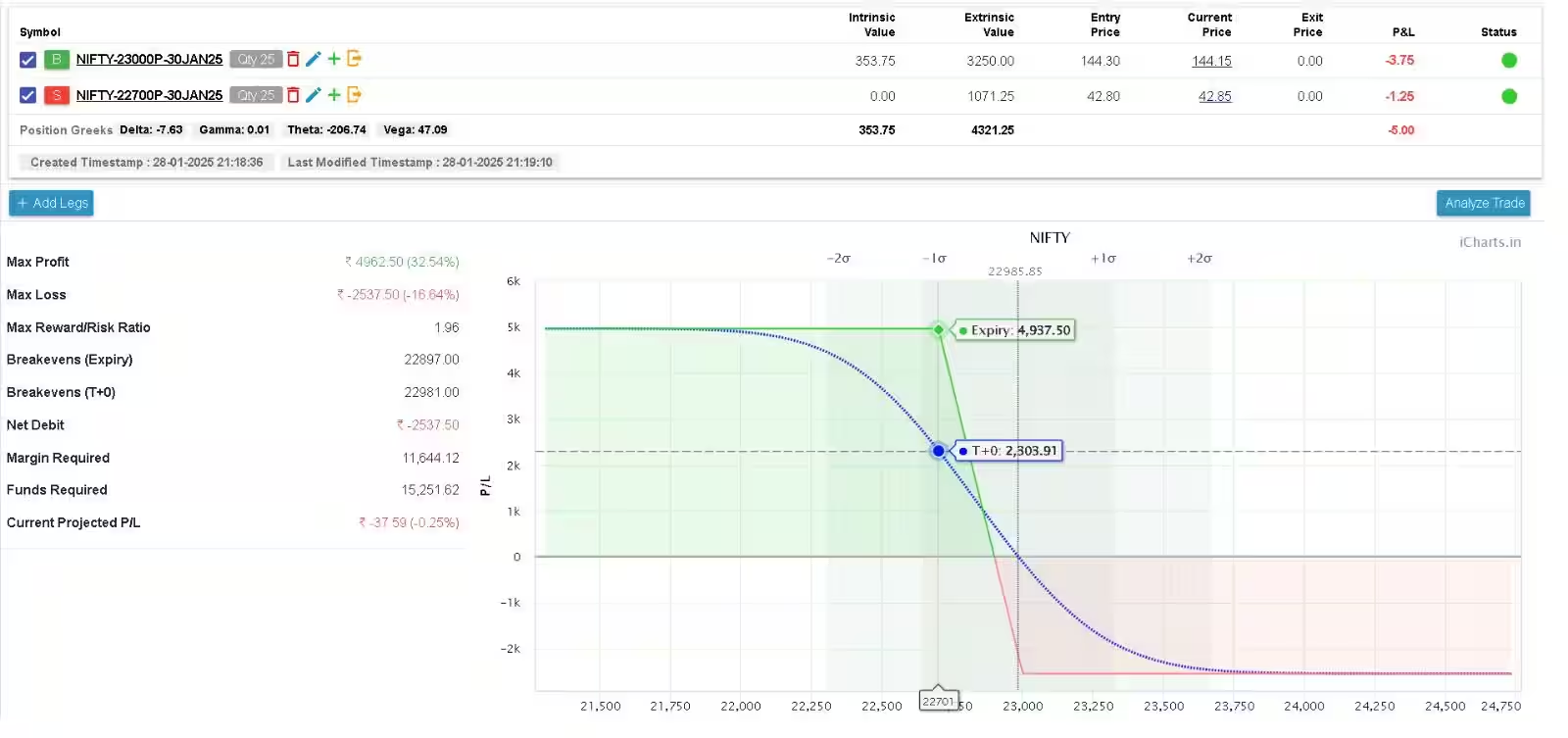

Strategy: Traders can implement a Bull Put Spread by buying the 23,000 strike Put at Rs 144 and selling the 23,300 strike Put at Rs 345, both for the January 30 expiry. In case of stop-loss, the strategy can be held until expiry, with the maximum loss capped at Rs 2,480. On the target front, hold the strategy till expiry for a maximum profit of Rs 5,020 or consider booking profits once the mark-to-market (MTM) profit crosses Rs 3,000.

Preeti K Chabra, Founder of Trade Delta

The VIX, often referred to as the “fear gauge,” is making a higher high and higher low sequence on the weekly chart and is now trading at 18.19, an increase of 8.66% this week. With the Union Budget on February 1, the VIX is expected to remain at higher levels, bringing discomfort to the bulls.

Nifty has been trading below all the major moving averages, with shorter moving averages crossing longer moving averages from above, suggesting a bearish market scenario. Furthermore, Nifty is trading at a Relative Strength Index (RSI) of 37.74, indicating bearish momentum. We see Nifty heading towards the recent low of 22,786, followed by 22,444, unless there is a positive surprise from the Union Budget. For the monthly expiry this week, we advise traders to continue with the "sell on rise" view in Nifty. To profit from the bearish trend, we can deploy a Bear Put Spread.

Key Resistance: 23,347, 23,426

Key Support: 22,786, 22,444

Strategy: Traders can use a Bear Put Spread strategy when they expect the price of an underlying asset to decline shortly. This involves buying and selling Put options with the same expiry but different strike prices. The higher strike price Put is bought (in the money) and the lower strike price Put is sold (out of the money). This strategy results in a net debit for the trader, as the cost of the in-the-money Put is adjusted with the cash flow from shorting the out-of-the-money Put.

Ashish Kyal, CMT, Founder and CEO of Waves Strategy Advisors

Nifty is experiencing high volatility, with prices fluctuating around the 23,000 level. There was a sharp move above 23,000 yesterday, with prices hitting an intraday high of 23,138. However, sharp selling in the final hour resulted in a fall of 200 points in less than 30 minutes. Such volatility suggests that the current market is more suited for short-term scalpers rather than positional traders.

For now, we can expect rangebound movement between 23,150 and 22,750 levels. A break of this range will drive the trend in that direction. Nifty’s major top was formed in September 2024 near 26,277, and since then, there has been a fall of more than 13%. The real pain is being seen in midcap and smallcap stocks, where some have corrected by anywhere from 30% to 50% in a short period.

In summary, we are seeing a systematic sell-off. A break above 23,150 will indicate a short-term low has been formed, which could open up an upside move to 23,450. Any break below 22,750 will resume the negative trend. Until then, trade the range between 22,750 and 23,150.

Key Resistance: 23,450

Key Support: 22,750

Strategy: Long positions in Nifty Futures can be created above 23,150, with targets of 23,250, followed by 23,300, and a stop-loss at 23,050.

Bank Nifty - Outlook and Positioning

Dhupesh Dhameja, Derivative Research Analyst at Samco Securities

The Nifty Bank index made a remarkable comeback, breaking its recent correction with the RBI’s liquidity infusion propelling it toward the critical psychological resistance at 49,000. On the daily chart, a bullish reversal Morning Star candlestick pattern signals a potential upside, with the index forming a solid base in the 48,000–47,800 range. Despite this recovery, the index remains capped below its 20-day EMA, a key resistance level at 49,300. While intraday gains were notable, profit-booking erased momentum, highlighting lingering selling pressure.

Currently, the index is navigating the pivotal 49,000–49,300 range, bolstered by intense Call writing activity, which adds to the resistance. The options market data reinforces the strong support zone, with significant put additions at lower strikes between 48,800 and 48,000, suggesting a defensive stance by traders. Meanwhile, the immediate resistance zone at 49,000–49,500 remains a significant hurdle for sustained upside. If the index decisively breaches 49,300, it could set the stage for a stronger recovery, targeting the psychological 50,000 mark, fueling optimism for further gains.

Key Resistance: 49,000, 49,300, 50,000

Key Support: 48,500, 48,000, 47,800

Strategy: Traders can implement a Call Ratio Back Spread by buying two lots of the 48,900 strike Call at Rs 325 and selling the 48,700 strike Call at Rs 430, for the January 30 expiry. In case of stop-loss, the strategy can be held until expiry, with the maximum loss capped at Rs 5,932. On the target front, hold the strategy till expiry for a maximum profit of Rs 30,461 or consider booking profits once the mark-to-market (MTM) profit crosses Rs 6,000.

Preeti K Chabra, Founder of Trade Delta

Bank Nifty rebounded sharply after the RBI announced liquidity-boosting measures with a potential rate cut in February. Bank Nifty is trading with an RSI of 43.37 on the daily chart, with a bullish crossover and breach of the trendline on the upside, suggesting further positive momentum. We advise traders to capitalize on this bullish momentum for this expiry. However, with India VIX trading at 18.19 and the Union Budget to be released on February 1, this could be a volatile week, so any position in Bank Nifty should be made with strict stop-loss.

Key Resistance: 49,650

Key Support: 48,203

Strategy: Buy Bank Nifty Futures for a target of 49,650, with a stop-loss of 48,203.

Ashish Kyal, CMT, Founder and CEO of Waves Strategy Advisors

Bank Nifty found support near the previous swing low of 47,898 and saw a sharp bounce on the upside. The index recovered by more than 1,100 points in the previous session. At the end of the day, the index closed above the previous day’s high. The current pullback has retraced more than 78.6% of the prior fall that occurred in the previous week. On the daily chart, prices seem to be forming a Double Bottom pattern. A break above 49,650 will confirm the breakout of this pattern, potentially leading to a fresh rise in Bank Nifty.

In summary, after a sharp fall, Bank Nifty witnessed a relief rally in the previous session. However, prices are still consolidating at the lower end. For now, a break above 49,300 is necessary for fresh buying to emerge, with targets of 49,450–49,650. On the downside, a break below 48,400 is essential for selling to resume.

Key Resistance: 49,650

Key Support: 48,400

Strategy: Long positions can be created above 49,300 with targets of 49,450, followed by 49,650, and a stop-loss at 48,050.

0 Comment