06 Jun , 2025 By : Debdeep Gupta

The buying interest continued in both benchmark and broader markets on June 5, ahead of the outcome of the RBI MPC meeting scheduled for June 6. The Nifty 50 closed half a percent higher, with the VIX dropping to a two-month low. The index climbed above short-term moving averages (10-day and 20-day EMAs) and the midline of the Bollinger Bands, signaling a positive trend. If the momentum sustains, the immediate hurdle for the index is seen at the 24,900 zone, followed by 25,000, as long as it holds above 24,500—the key support zone, according to experts.

Here are 15 data points we have collated to help you spot profitable trades:

1) Key Levels For The Nifty 50 (24,751)

Resistance based on pivot points: 24,864, 24,932, and 25,041

Support based on pivot points: 24,645, 24,577, and 24,468

Special Formation: The Nifty 50 formed a bullish candle with a long upper shadow on the daily charts, indicating an upside bounce amid volatility and selling pressure at higher levels. The index needs to sustain above the midline of the Bollinger Bands for a further upmove, while the trading volume was better than in the previous session. The RSI, at 55.14, is inclined upward, while the Stochastic RSI showed a positive crossover in the lower zone.

2) Key Levels For The Bank Nifty (55,761)

Resistance based on pivot points: 55,948, 56,049, and 56,214

Support based on pivot points: 55,620, 55,518, and 55,354

Resistance based on Fibonacci retracement: 56,307, 58,648

Support based on Fibonacci retracement: 54,117, 52,892

Special Formation: The Bank Nifty sustained near its all-time high zone, forming a Doji-like candlestick pattern for the second consecutive session, signaling indecision among buyers and sellers ahead of the RBI policy outcome. Meanwhile, the index remained above all key moving averages, and the RSI at 60.47 showed a positive crossover.

3) Nifty Call Options Data

According to the weekly options data, the 25,000 strike holds the maximum Call open interest (with 47.52 lakh contracts). This level can act as a key resistance for the Nifty in the short term. It was followed by the 25,500 strike (46.5 lakh contracts), and the 24,800 strike (39.26 lakh contracts).

Maximum Call writing was observed at the 24,800 strike, which saw an addition of 24.74 lakh contracts, followed by the 25,000 and 25,400 strikes, which added 20.63 lakh and 19.73 lakh contracts, respectively. The maximum Call unwinding was seen at the 24,600 strike, which shed 3.21 lakh contracts, followed by the 24,650 and 24,550 strikes which shed 86,250 and 9,675 contracts, respectively.

4) Nifty Put Options Data

On the Put side, the maximum Put open interest was seen at the 24,000 strike (with 35.91 lakh contracts), which can act as a key support level for the Nifty. It was followed by the 24,700 strike (35.88 lakh contracts) and the 24,500 strike (33.03 lakh contracts).

The maximum Put writing was placed at the 24,700 strike, which saw an addition of 27.78 lakh contracts, followed by the 24,800 and 24,500 strikes, which added 24.53 lakh and 19.65 lakh contracts, respectively. There was hardly any Put unwinding seen in the 23,900-25,850 strike band.

5) Bank Nifty Call Options Data

According to the monthly options data, the 56,000 strike holds the maximum Call open interest, with 22.78 lakh contracts. This can act as a key resistance level for the index in the short term. It was followed by the 57,000 strike (11.19 lakh contracts) and the 58,000 strike (7.68 lakh contracts).

Maximum Call writing was visible at the 57,000 strike (with the addition of 96,540 contracts), followed by the 56,000 strike (41,070 contracts), and the 58,000 strike (34,560 contracts). The maximum Call unwinding was seen at the 55,600 strike, which shed 56,190 contracts, followed by the 55,500 and 57,500 strikes, which shed 47,430 and 42,300 contracts, respectively.

6) Bank Nifty Put Options Data

On the Put side, the maximum Put open interest was placed at the 56,000 strike (with 16.86 lakh contracts), which can act as a key level for the index. This was followed by the 55,000 strike (11.35 lakh contracts) and the 55,500 strike (6.82 lakh contracts).

The maximum Put writing was observed at the 55,800 strike (which added 63,120 contracts), followed by the 55,700 strike (43,770 contracts) and the 55,000 strike (29,790 contracts). The maximum Put unwinding was seen at the 55,400 strike, which shed 12,450 contracts, followed by the 55,300 and 54,200 strikes, which shed 6,660 and 6,330 contracts, respectively.

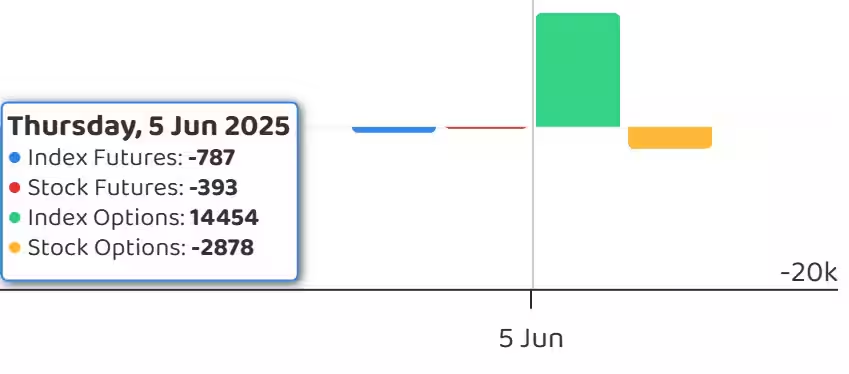

7) Funds Flow (Rs crore)

8) Put-Call Ratio

The Nifty Put-Call ratio (PCR), which indicates the mood of the market, jumped to 0.98 on June 5, from 0.73 in the previous session.

The increasing PCR, or being higher than 0.7 or surpassing 1, means traders are selling more Put options than Call options, which generally indicates the firming up of a bullish sentiment in the market. If the ratio falls below 0.7 or moves towards 0.5, then it indicates selling in Calls is higher than selling in Puts, reflecting a bearish mood in the market.

9) India VIX

Bulls turned more comfortable on Thursday as the India VIX—the fear gauge—fell for the third straight session, declining 4.21 percent to 15.08, its lowest level since April 4.

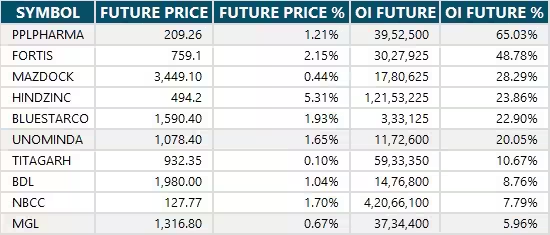

10) Long Build-up (75 Stocks)

A long build-up was seen in 75 stocks. An increase in open interest (OI) and price indicates a build-up of long positions.

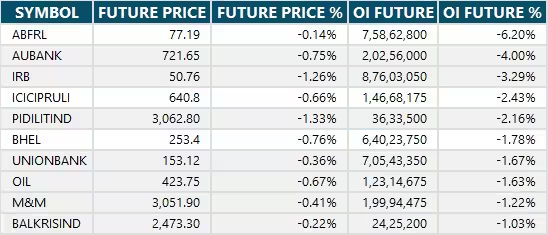

11) Long Unwinding (30 Stocks)

30 stocks saw a decline in open interest (OI) along with a fall in price, indicating long unwinding.

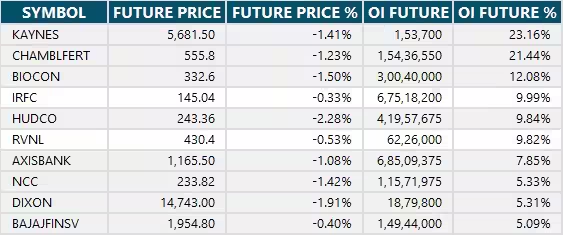

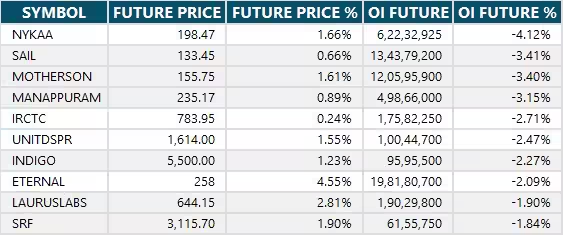

12) Short Build-up (62 Stocks)

62 stocks saw an increase in OI along with a fall in price, indicating a build-up of short positions.

13) Short-Covering (57 Stocks)

57 stocks saw short-covering, meaning a decrease in OI, along with a price increase.

14) High Delivery Trades

Here are the stocks that saw a high share of delivery trades. A high share of delivery reflects investing (as opposed to trading) interest in a stock.

15) Stocks Under F&O Ban

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Stocks added to F&O ban: Chambal Fertilisers and Chemicals

Stocks retained in F&O ban: Aditya Birla Fashion and Retail, Manappuram Finance

Stocks removed from F&O ban: Nil

0 Comment