11 Jul , 2025 By : RAJIV DUTTA

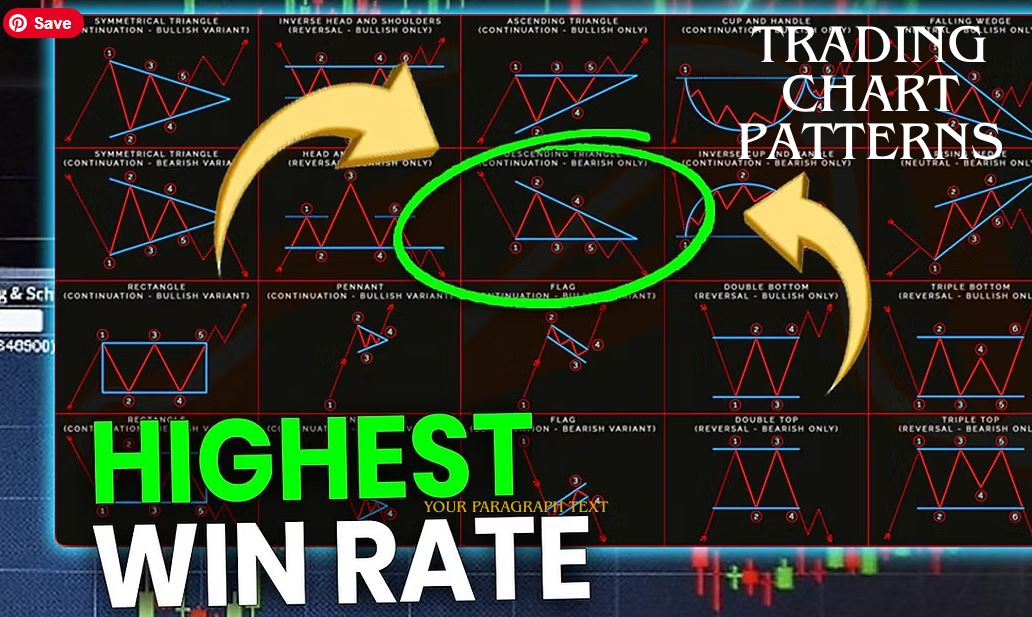

In the world of stock trading,

technical analysis is incomplete without understanding trading chart

patterns. Whether you are a beginner or an experienced trader, recognizing

these patterns can significantly improve your entry and exit strategies. In

this post, we'll explore the top 10 most powerful chart patterns used by

successful traders in 2025.

Top

10 Trading Chart Patterns You Must Know

1. Head and Shoulders

2.

Double Top and Double Bottom

3.

Cup and Handle

4.

Ascending Triangle

5.

Descending Triangle

6.

Flag and Pennant Patterns

7.

Symmetrical Triangle

8.

Wedge Patterns (Rising/Falling)

9.

Rectangle Pattern

10.

Inverse Head and Shoulders

Why

Learn Trading Chart Patterns?

Bonus

Tips for Chart Pattern Trading

Conclusion

Mastering trading chart patterns

is essential for anyone serious about technical trading. While no pattern

guarantees profits, they offer high-probability setups when used with

confirmation indicators and strong risk management.

If you're just starting out, begin

by learning the most common ones like Head and Shoulders, Triangles,

and Flags. With practice and patience, these patterns can become your

secret weapon in the stock market.

Want

More?

Follow our Telegram channel for daily stock market tips, intraday signals, trading chart patterns, index option trading and live chart setups.

-> Join Dream Nifty -

Free Stock Market Tips

0 Comment