12 Nov , 2022 By : Monika Singh

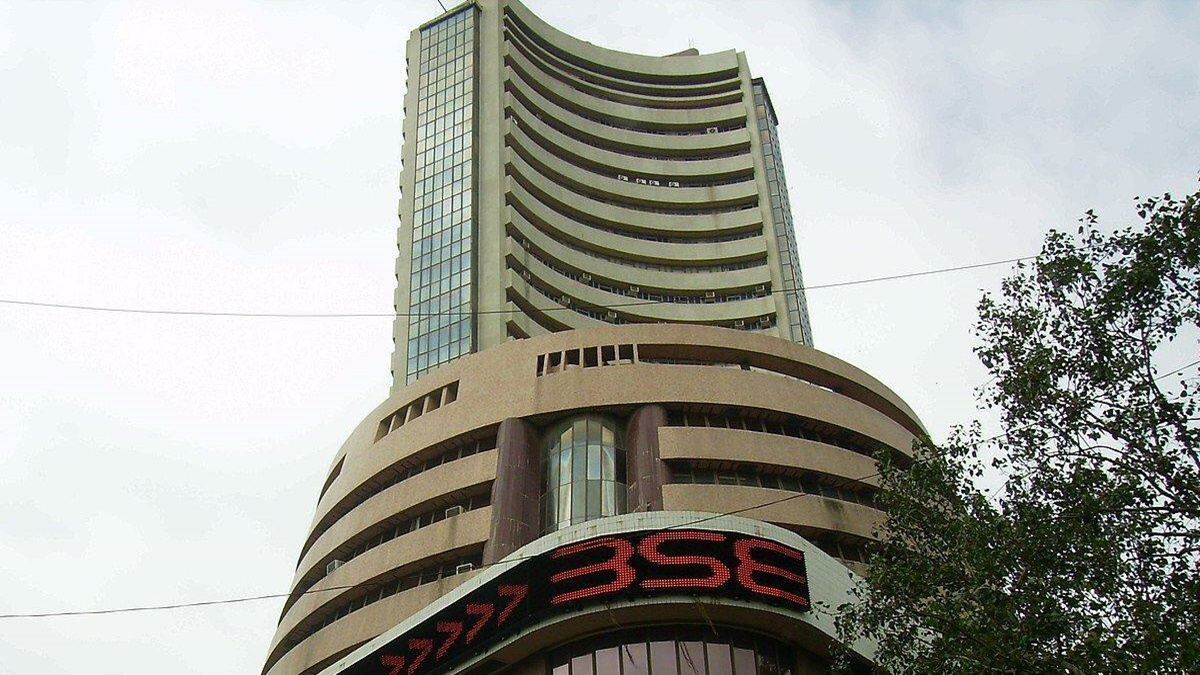

The BSE Sensex and NSE Nifty might have risen by almost 2% on Friday but the broader market did not show the same enthusiasm. Both BSE midcap and BSE smallcap indices underperformed their benchmark peers and ended with nominal gains. The BSE midcap index rose 37.22 points (0.15%) to close at 25,465.20 while the BSE smallcap gained 95.58 points (0.33%) to close at 28,985.06.

Experts believe that such concentrated rallies happen when the market is uncertain about the future. So, they go by the positive, or on bad days, the negative news of the day. For Indian markets, the lower-than-expected US inflation numbers were the trigger, but not convincing enough for a broad-based rally.

“Normally few shares lead the rally during uncertain times. For a broad-based rally, one requires certainty. While the US inflation has come below expectations, markets will need more data to believe that it is a trend,” said Nilesh Shah, MD, Kotak Mutual Fund.

On Thursday, the selective rally was clearly reflected in the US markets as well. The Dow Jones’ 3.7% rise was largely on the back of beaten-down IT majors such as Apple, Microsoft, Alphabet, Meta, Amazon and Nvidia. The Indian markets followed the same template, except for the HDFC twins. IT majors Infosys, Tata Consultancy Services (TCS), Tech Mahindra, HCL Technologies and Wipro led the rally and were up over 3%. The BSE IT index closed higher by 3.70% or over 1,060 points.

In fact, the rally was so narrow that only Nifty IT, Nifty Financial Services, and Nifty Metal indices closed over 2%. All the other sectoral indices were up less than the benchmark indices, with Nifty Auto, Nifty PSU banking and NSE FMCG closing marginally down.

Market players say that such rallies may continue in the future, primarily because of the overall uncertainty in the global markets. “So, there is a strong possibility that the market may latch on to themes or stocks in the news in the coming days instead of a broader rally,” said a fund manager who did not wish to be named.

Arun Kejriwal, founder, Kejriwal Research and Financial Services said: “Our markets are dangerously close to all-time highs. What happens in the global markets is important now. Of course, there will be few aberrations when US markets rise & we fall and vice versa. But more or less, we will be propped up/down, depending on the overall market mood.”

According to him, traditionally, such selective rallies do not last too long. So, it makes sense for investors to be cautious during such times.

0 Comment