11 Jun , 2024 By : Debdeep Gupta

The technical patterns of shares of HCL Technologies suggest a positive bias from a short-term perspective, with a minor rise in open interest in the futures segment, and the OI increasing by 5.50 percent despite a down day on Monday.

According to Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox, "technically, the stock has crossed the 200-day moving average (DMA) and 50-DMA, set at 1379 and 1397 respectively, signaling a positive bias for the upcoming sessions."

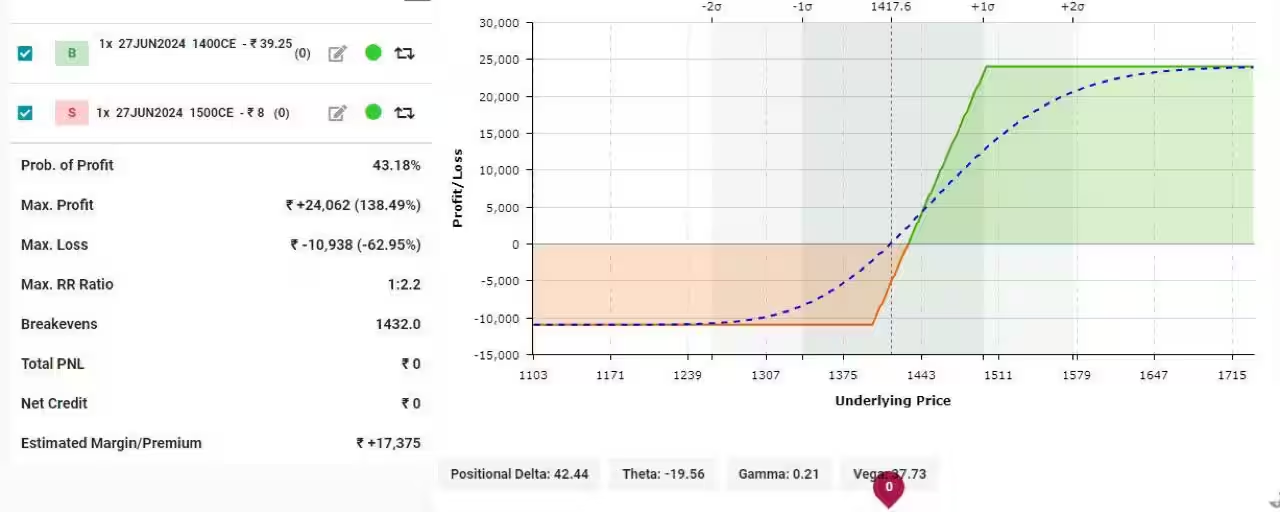

Bagkar suggests a bull call spread option strategy to tap the momentum:

Strategy Recommended by StoxBox

- Position: Buy 27 June 1400 CE at around Rs 39 and sell 27 June 1500 CE at Rs 8.

- Maximum Profit: Rs 24,000

- Maximum Loss: Rs 10,900

- Risk to Reward Ratio: 1:2.2

"We recommend going long on the 27 June 1400 CE around Rs 39 and simultaneously shorting the 27 June 1500 CE at Rs 8. The maximum profit is Rs 24,000, and the maximum loss is Rs 10,900. The risk-to-reward ratio is 1:2.2. The estimated margin stands at Rs 17,300," he said.

Derivative Cues

StoxBox's Bagkar noted that the derivative analysis of HCL Technologies suggests a positive bias from a short-term perspective. The PCR is 0.52, with at-the-money IV trading at 26, indicating a positive reversal.

"Despite a decline of over a percent on Monday, the stock saw a minor rise in open interest in the futures segment, with the OI up by 5.50 percent. The stock is trading at a discount of 1.15 in the derivative segment," he said.

According to the data, Bagkar highlights that the immediate hurdle is 1440, which has the highest OI, favoring writing in CE options. "There was a usual addition of OI in 1400 PE options, indicating sluggish weakness rather than an aggressive sell-off bias," added Bagkar.

Technical View

Shares of HCL Tech have crossed the 200-day moving average (DMA) and 50-DMA, set at 1379 and 1397 respectively; this, according to Bagkar, signals a positive bias for the upcoming sessions. Furthermore, the stock has filled the gap in April of this year. "The immediate trend reflects a rally towards the 1500 level, its 100-DMA," he emphasized.

0 Comment