10 Jun , 2024 By : Debdeep Gupta

Indian benchmark indices are trading higher amid volatility. Nifty is trading around all-time high levels at 23,300. As per experts, Nifty is likely to trade neutral with short-term support between 22,950-23,000 and resistance at 23,450-23,500 levels.

At 12:04 hrs IST, the Sensex was up 81.54 points or 0.11 percent at 76,774.90, and the Nifty was up 45.80 points or 0.20 percent at 23,336.00. About 2,447 shares advanced, 991 shares declined, and 106 shares unchanged.

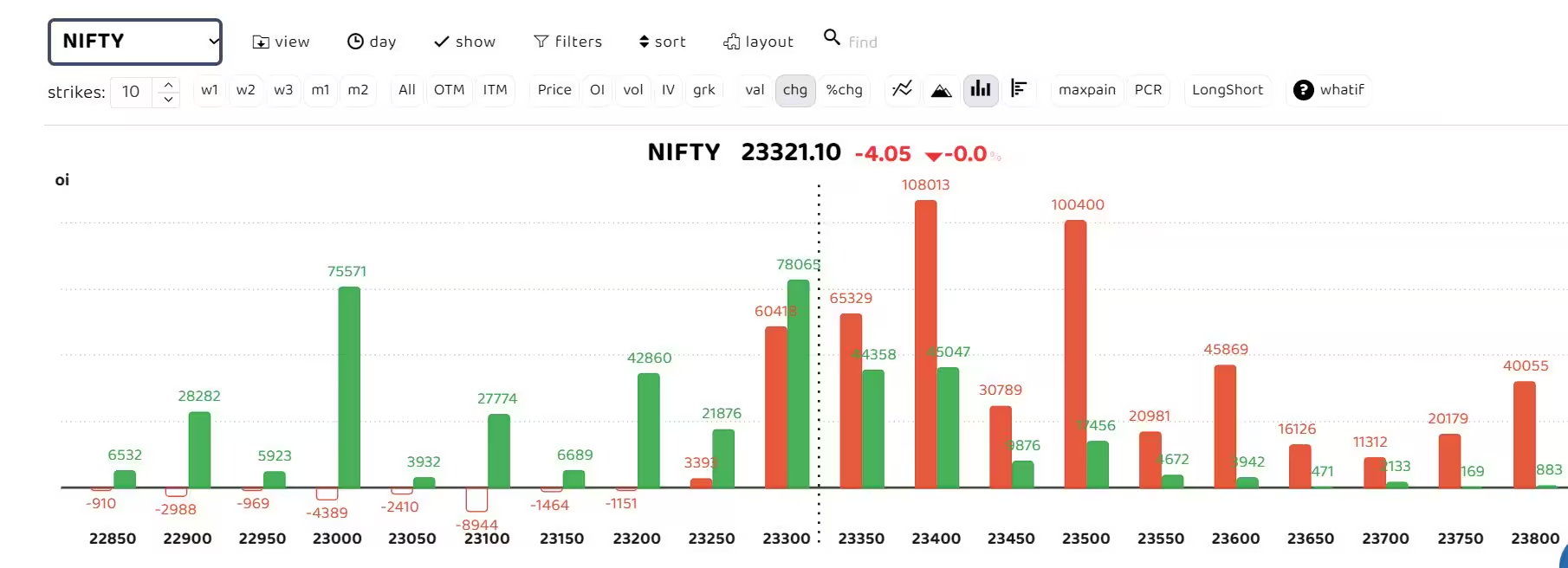

Bars in red indicate the change in open interest (OI) of call writers, while the green bars show the change in OI of put writers

Options data suggests heavy call writing at 23,600, 23,700, and 23,800 strikes.

"The index has hit a new all-time high, steering more positive momentum for upcoming sessions. The price action depicts a move to the 24,000-mark, which should occur once the index stabilizes above 23,200 for two consecutive sessions," said Avdhut Bagkar, Derivatives & Technical Analyst at StoxBox.

"The index must sustain above the upward rising trend line drawn from the peaks of January, March, and April. The underlying bias remains highly optimistic as long as the support at 22,500, its 50-daily moving average (DMA), is defended. The strength oscillator, Relative Strength Index, has yet to enter the overbought category, signaling more scope for upside," added Bagkar.

"NIFTY is likely to trade neutral. NIFTY short-term support is between 22,950-23,000 and resistance is between 23,450-23,500, " said derivatives trader- Santosh Pasi.

Among individual stocks, the long build-up is seen in MGL, Ramcocements, Ultratech cement, and India Cements. Short build-up is seen in Coforge, Mphasis, and Lupin.

0 Comment